Table of Contents

You are preparing for your next meeting with your financial advisor or trusted financial professional, and they send you a note about coming to the sit-down with any questions. If you are meeting for the first time as a client or have been making these trips for years, you should always arrive prepared to soak up any expertise you can, because knowledge is power when it comes to your finances.

So what are the right questions to be asking? While you might have some that are very specific to your own financial situation, let’s walk through some general questions that everyone should be asking the next time they are face-to-face with their favorite financial expert.

1. Is My Current Financial Plan Still Aligned With My Goals And Life Changes?

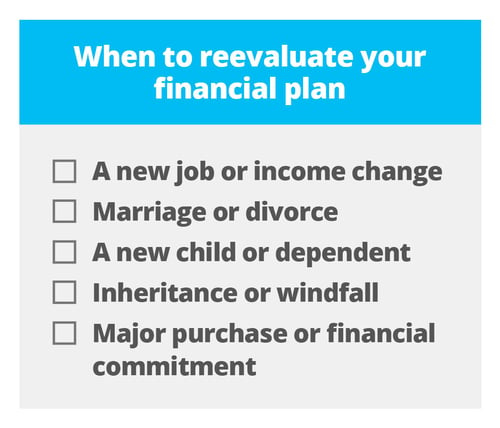

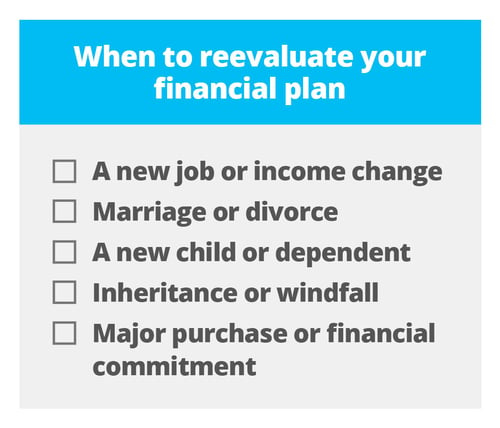

Life isn’t static, and your financial plan shouldn’t be either. Whether you’ve changed jobs, gotten married, had a child, bought a home, or simply entered a new phase of life, these shifts should be reflected in your financial strategy.

Your advisor can walk you through your existing plan and identify areas that need adjusting. This is especially important during your annual review, where you assess whether your financial goals, income, expenses, or priorities around wealth management have changed. Don’t be afraid to be transparent about financial life updates. The more your advisor knows, the more effectively they can help you make informed, strategic decisions.

2. Am I Saving Enough For Retirement, and Are My Retirement Accounts Working Efficiently?

Saving for retirement isn’t just about putting money away. It’s about making sure your contributions, account types, and investment strategies are all working together efficiently to support the future you envision.

Your advisor can help you evaluate whether you’re contributing enough and to the right accounts. For example, are you maximizing your employer match in a 401(k)? Should you be contributing to a Roth IRA for tax-free growth, or a traditional IRA for upfront deductions?

They’ll also look at how your retirement accounts are invested. Is your current asset allocation appropriate for your age, timeline, and retirement goals? Are there accounts you could be using more strategically for tax advantages or better diversification? Asking this question opens the door to a full retirement planning review, helping ensure you’re not just saving, but saving smart.

3. Are There Any Inefficiencies or Hidden Fees in My Investment Portfolio?

Even a well-performing portfolio can quietly lose money to inefficiencies, and many investors don’t realize it until it’s too late. Hidden fees, outdated fund choices, or poorly diversified assets can drag down your returns over time. This is where your financial advisor plays a crucial role.

Ask your advisor to break down the fees associated with your investments based on their investment philosophy. This includes:

- Expense ratios on mutual funds or ETFs

- Advisor fees (Are they fee-only, commission-based, or a hybrid?)

- Trading or transaction costs

- Account maintenance or custodial fees

These fees might seem small on paper (0.5% here, 1% there), but over the years, they can significantly impact your investment portfolio growth.

Beyond fees, inefficiencies can show up in other ways, too:

- Overlapping holdings across multiple funds

- Tax-inefficient investments in taxable accounts

- Poor diversification or overexposure to a single sector or company

Your advisor should help you optimize your portfolio so it’s cost-effective, tax-smart, and aligned with your goals, not just built on autopilot. Asking this question encourages transparency and helps you take control of where your money is really going.

4. How is My Asset Allocation Positioned in Today’s Market?

Asset allocation drives long-term performance. It's the mix of stocks, bonds, cash, and other investments in your portfolio, and it plays a bigger role in your overall returns than picking individual stocks or timing the market.

Your advisor can help you adjust that mix based on your time horizon (how long until you need the money) and your risk tolerance (how much market fluctuation you’re comfortable with). For example, someone in their 30s might lean more heavily into equities for long-term growth, while someone nearing retirement may need more stability and income-producing assets. Asking this question helps you understand not just what you’re invested in but why and how that strategy aligns with your current and future needs.

5. Can You Help Me Develop A Strategy For Managing Debt, Especially Credit Card Balances or Student Loans?

Debt can be a major drag on your financial progress, but it doesn’t have to be. A smart advisor will help you look at debt not as a failure, but as a tool that needs to be managed strategically.

Start By Reviewing What Kinds of Debt You Have:

Start By Reviewing What Kinds of Debt You Have:

Your advisor can help you build a repayment plan that fits your budget and goals. They can also help you avoid taking on unnecessary debt in the future by guiding you through big purchases or financial decisions. Debt doesn’t disqualify you from wealth-building, but unmanaged, it can derail it. Asking this question brings it out into the open and helps you take back control.

6. What Do You Wish More Clients Asked You?

While this question doesn’t pertain directly to your money, this could open doors to new strategies or investment advice you didn’t consider, create a stronger relationship with your advisor, and also tap into even more financial expertise that you could use now or in the future.

Your advisor might not have brought up certain types of investments because you had not expressed interest, or maybe it is something up-and-coming that is not on the radar, or for most people, stepping into their office. You might be dreaming about one day owning a vacation home and not know that your advisor is actually a multi-property owner themselves. A great relationship with someone who knows the ins and outs of your money means more transparency, care, and insight that could help you reach your goals faster and more efficiently. Each client is unique, and your financial plan reflects that. As your advisor, they are being paid to give a client the best possible advice for their financial life.

7. How Often Should We Update or Revisit My Financial Plan?

A great financial plan isn’t one you create once and forget; it’s a living document. The best advisors schedule regular reviews with you as a client (usually annually or semi-annually) to make sure your goals, savings, investments, and risks all remain aligned.

Your advisor should also be proactive about reviewing your financial situation when major life events occur, such as:

Asking this question sets the expectation for ongoing communication and helps ensure your financial plan stays current, not outdated.

Addition Financial Helps You Prepare

We hope you don’t just nod along at your next meeting, but choose to engage more with your financial resource. Many clients rely on a good financial advisor’s expertise, but forget that financial planning is a two-way conversation, and asking the right questions is one of the most powerful tools you have. And these 7 questions should have you starting off right with getting the best financial advice.

We hope you don’t just nod along at your next meeting, but choose to engage more with your financial resource. Many clients rely on a good financial advisor’s expertise, but forget that financial planning is a two-way conversation, and asking the right questions is one of the most powerful tools you have. And these 7 questions should have you starting off right with getting the best financial advice.

If you're focused on retirement planning, debt management, or simply trying to make smarter decisions with your money, your next meeting is an opportunity to get clarity and make sure your financial plan is working for you, not just sitting in a folder collecting dust.

These questions will help you take a more active role in your personal finance journey, uncover opportunities you may be missing, and strengthen your relationship with your advisor, no matter if they’re a certified financial planner (CFP®) or an investment specialist. At Addition Financial, we provide resources and products that will set you up for success when learning more about financial planning and preparing for your future. Come talk to us with your notes from your meeting, and we will see how our services can best work with your game plan.

Start By Reviewing What Kinds of Debt You Have:

Start By Reviewing What Kinds of Debt You Have:

We hope you don’t just nod along at your next meeting, but choose to engage more with your financial resource. Many clients rely on a good financial advisor’s expertise, but forget that financial planning is a two-way conversation, and asking the right questions is one of the most powerful tools you have. And these 7 questions should have you starting off right with getting the best financial advice.

We hope you don’t just nod along at your next meeting, but choose to engage more with your financial resource. Many clients rely on a good financial advisor’s expertise, but forget that financial planning is a two-way conversation, and asking the right questions is one of the most powerful tools you have. And these 7 questions should have you starting off right with getting the best financial advice.