Table of Contents

1. Where Skimming Happens

2. How Criminals Steal Your Card Information

3. How to Protect Yourself from Card Skimming

4. What to Do If You Suspect Skimming

5. Addition Financial Helps Protect Your Money

Fraudulently taking card details using a device called a “skimmer” or the act of “skimming” has been on the rise, with some retailers no longer taking cash, and the continued convenience of paying with a card. Scammers will illegally install a skimmer into a payment terminal where an unsuspecting victim will swipe or insert their card to capture card details via the magnetic stripe or chip, and sometimes even more advanced models can track the input of PINs. And this is just the beginning. This information is then downloaded and used to create counterfeit cards, to sell financial information, or to attempt to drain your account.

It’s important to understand what to look for when making purchases to avoid skimming, so we’ll let you know the red flags and what to do if you think you may have been scammed.

Where Skimming Happens

Skimming can happen almost anywhere you swipe, insert, or tap your credit or debit card, but some locations are more vulnerable than others, especially those with unattended or lightly monitored machines. Knowing where to be extra cautious can reduce your risk of fraud significantly.

Common locations for card skimming include:

- ATMs – Especially standalone machines not directly attached to a bank.

- Gas pumps – These are frequent targets because they often have older card readers and minimal supervision.

- Retail point-of-sale terminals – Particularly in high-traffic or busy stores, where tampered devices may go unnoticed.

- Vending machines – Easy to access and modify, making them an ideal setup for a skimmer.

High-risk scenarios include:

- Unattended machines – Devices in remote or low-traffic areas can be compromised more easily.

- Late-night transactions – Less staff oversight at night gives scammers more opportunity to install or retrieve skimming equipment.

Always be alert when using your card, especially in these environments. A quick scan of the card reader and a few seconds of caution can help you avoid becoming a skimming victim.

How Criminals Steal Your Card Information

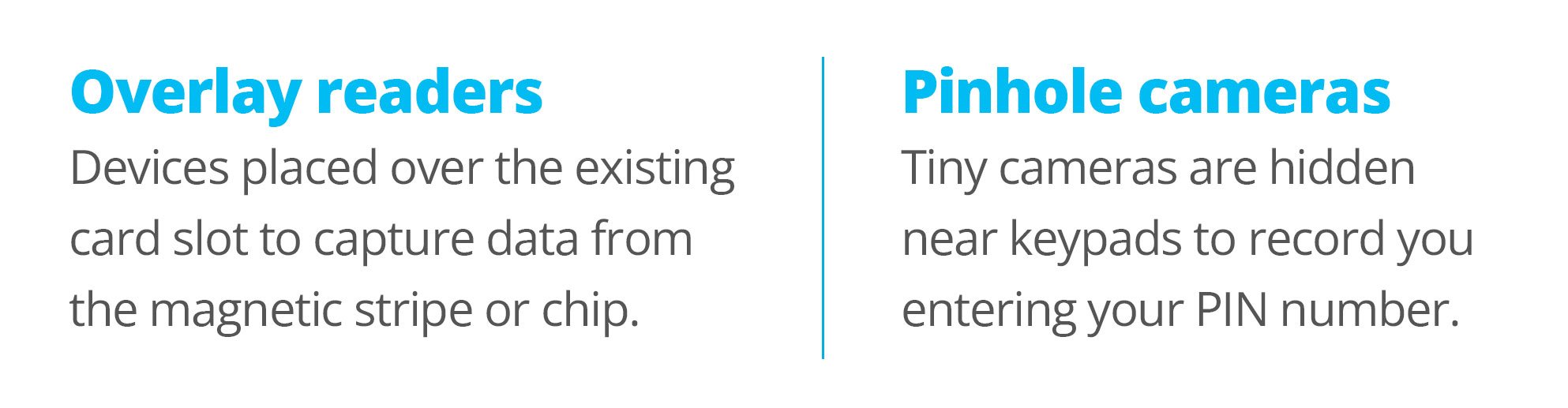

Criminals use discreet, often unnoticeable devices to steal your card information, and they’re getting more sophisticated by the day. These tools are designed to look like part of the machine, making them difficult to spot with an untrained eye. It’s a misconception that chip cards are less vulnerable to skimming, as scammers have also made chip reader skimmers to keep up with credit card companies.

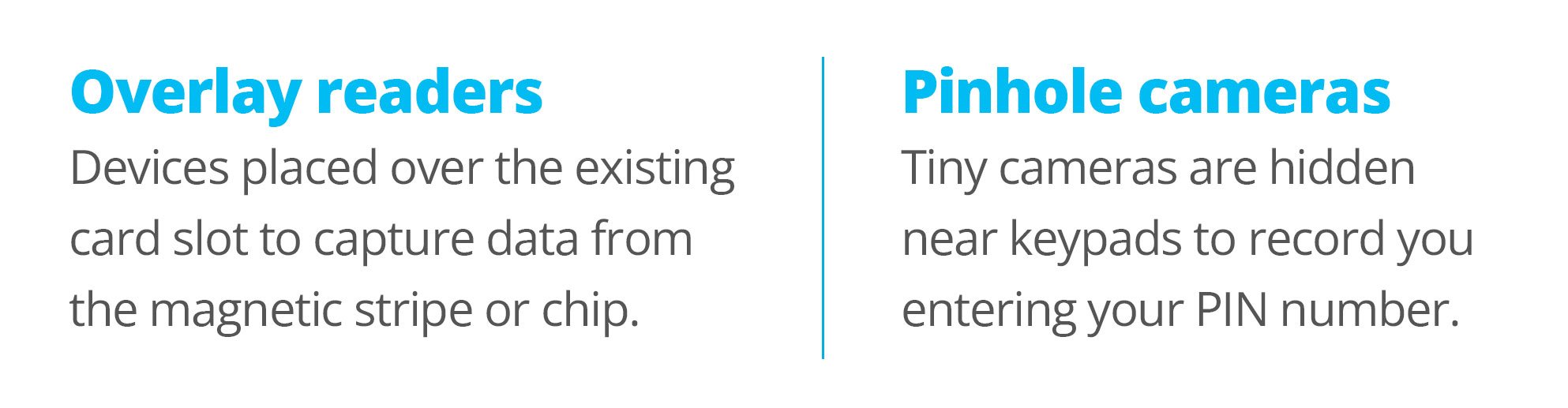

Common skimming devices include:

Unfortunately, once skimming occurs, fraud can happen within minutes. That’s why it’s critical to act fast if you suspect anything unusual and to take steps now to protect your card before scammers get the chance.

Signs of a Skimming Device

So what should you be looking for while you are on the lookout for a device trying to snatch your information? Visual cues are critical. If you notice that the card slot at the payment terminal seems loose or if it looks like it is too bulky for the main component of the machine, that’s a red flag. Some devices have to be physically installed, so if you are seeing signs of tampering like cracked pieces, extra screws, or even, in some cases, tape or glue, you should be wary of the terminal.

At first glance, does it look like the point where you are swiping or inserting your card is streamlined to the rest of the device? If it is a different color, looks mismatched, or does not seem like it is attached properly in one piece, don’t place your card into it. Ask the cashier if they accept other forms of payment, or maybe rethink your purchase.

How to Protect Yourself from Card Skimming

While skimming scams are increasingly sophisticated, there are still simple and effective ways to reduce your risk. By developing smart habits and using modern payment technology, you can stay one step ahead of fraudsters.

Practice Smart ATM and Shopping Habits

Use these questions to guide your purchase behaviors.

- Where is the ATM I’m using located?

Stick to ATMs located inside or directly connected to banks. They’re more secure, well-lit, better monitored, and less likely to be tampered with compared to standalone machines in convenience stores or gas stations, especially at night.

- Am I protecting my PIN?

Whether you’re using an ATM or paying at a terminal, always use your hand or body to shield the keypad. This can block pinhole cameras or onlookers from stealing your PIN.

- Am I checking the card reader?

Before inserting your card, gently pull or wiggle the card reader. If it feels loose, bulky, or misaligned, it could be a skimming device placed over the real reader. If anything seems suspicious, cancel the transaction and report it.

Leverage Safer Payment Technology

- Use tap-to-pay or mobile wallets.

Contactless payments via your phone or smart card reduce the need to insert your card into machines altogether, minimizing the risk of skimming. Mobile wallets also use tokenization, which adds an extra layer of protection.

- Use chip cards instead of magnetic stripes.

EMV chip technology is far more secure than traditional magnetic stripes. It generates a unique transaction code each time you use your card, making it harder for criminals to clone.

Monitor Your Accounts Frequently

Are you checking your bank and credit card accounts regularly? Take the time to periodically log in to your online or mobile banking account to scan for unauthorized transactions. The sooner you spot suspicious activity, the faster you can respond. We recommend setting up transaction alerts on your phone. With Addition Financial’s digital banking, you can enable real-time alerts for purchases, withdrawals, or unusual activity, helping you catch fraud before it escalates.

By staying alert and proactive, you can dramatically reduce the chance of falling victim to card skimming. A few quick precautions can save you a lot of time, stress, and money down the road.

What to Do If You Suspect Skimming

If something feels “off” when you’re using your card or you notice strange activity on your account, don’t ignore it. Quick action is key to minimizing damage and securing your finances.

Signs Your Card May Have Been Compromised

Some red flags that could indicate you've been a victim of card skimming include:

- Unexpected transactions or withdrawals you don’t recognize

- Being locked out of your online banking or mobile app

- A transaction decline followed by suspicious activity

- A card reader or ATM that looked or felt tampered with

Ask Yourself These Questions:

To help assess whether you may have been skimmed, consider:

- Did the card reader feel loose, bulky, or oddly placed?

- Was I at an unattended or poorly lit machine?

- Did I notice any extra attachments near the keypad or card slot?

- Did I forget to shield my PIN when entering it?

- Have I seen any strange or unauthorized transactions on my account?

- Did I use an ATM or gas pump in an unfamiliar area?

If you answer yes to any of these, it's smart to take action right away.

3 Immediate Steps to Take:

- Freeze your card

Most banks and credit unions (including Addition Financial) allow you to temporarily lock or freeze your card through a mobile app or online banking. This prevents any further unauthorized transactions.

- Contact Addition Financial or your credit card issuer

Reach out immediately to report the suspected fraud. They can block your card, investigate the activity, and issue a replacement if needed.

- Report suspicious devices

If you notice a tampered ATM, gas pump, or payment terminal, alert the business owner or manager right away. You can also report it to local law enforcement, especially if others may be at risk.

Taking swift action can limit the financial and emotional toll of skimming fraud and help prevent others from becoming victims, too. An easy way to remember these steps is the 3 first three words, “freeze, contact, report.”

Addition Financial Helps Protect Your Money

At Addition Financial, we are always looking out for your money and its security. Remember to be proactive, informed, and cautious when making regular purchases, especially if paying somewhere new or unfamiliar. The easiest way to protect yourself is to pay attention to your accounts; that way, you can notice any issues and rectify them quickly. We will work quickly if your card has been compromised to get you a new card or freeze your accounts. Through our digital banking tools, you can have full transparency with notifications and other resources.

Addition Financial’s Security Center is your go-to hub for guides on preventing theft and fraud. It provides step-by-step instructions for actions such as placing credit freezes, filing disputes, and recovering from the theft of personal or financial information. You may know now what to look for when hunting for skimming devices, but do you have a plan for if a different type of financial emergency strikes? Check out our Emergency Savings Plan Builder to prepare yourself for life’s what-ifs.

/AFCU_93-EmergencySavingsPlan-CTA.jpg?width=1143&height=262&name=AFCU_93-EmergencySavingsPlan-CTA.jpg)

/AFCU_93-EmergencySavingsPlan-CTA.jpg?width=1143&height=262&name=AFCU_93-EmergencySavingsPlan-CTA.jpg)