When it’s time to start college, it’s common for students and their parents to spend a lot of time planning. They make lists, buy dorm room necessities and set up funds to buy books and food.

What a lot of them don’t do is create a budget. And yet, learning how to budget money in college is an essential life skill. If you learn how to budget while you’re still a young adult, you’ll carry the skill – and the lessons that go along with it – with you for your entire life.

At Addition Financial, we want our young clients to have a bright financial future. We asked some of our favorite financial experts this question:

“How can college students create and stick to a budget?”

Here’s what they had to say – and some step-by-step instructions to help you create and stick to a budget.

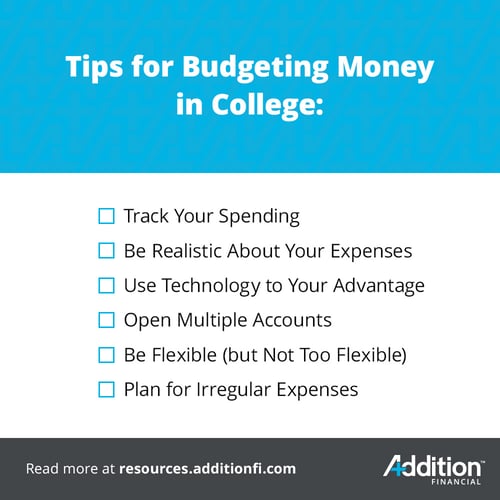

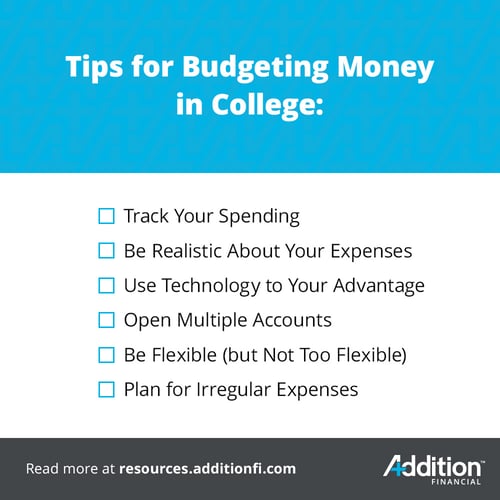

Track Your Spending

Budgeting starts with understanding how much you spend – and where and how you spend it. Financial expert Ilene Davis, author of Wealthy by Choice: Choosing Your Way to a Wealthier Future, says:

“An easy way to start is to take all spending from the past 6 (preferably 12) months, to see where they spent money in the past. Total up by category, and that can be the start of a budget.”

Blogger Gladice Gong of Earn More Live Freely offers this advice, too:

“[College students] should find out how they are spending their money currently by using a 30-day spending log. With this information, it's easier for them to know what is a realistic budget they can set for necessities, discretionary spending as well as savings and debt repayment.”

We would add that everybody, even adults, can lose track of what they spend if they’re not careful. We live in a society where buying on credit is the norm and the opportunity to make impulse purchases is everywhere – even in our homes. Tracking your spending is a good way to learn to be mindful as well as being an important first step in creating a budget.

Be Realistic About Your Expenses

Your expenses in college can fluctuate quite a bit based on the specifics of your life and needs. Molly Ford-Coates of Ford Financial Management says:

“Creating a budget in college is very important because the expenses can vary from year to year depending on if you are living on campus, moving into an apartment, living on your own or with roommates, and how many classes you are taking for that semester. Having a way to track all of these variables can be vital to your financial health. Without sticking to a budget, it can be likely that you will turn towards debt to fund your expenses.”

When you make your budget, set up major categories for:

Any time your circumstances change, you’ll need to revisit your budget. For example, if you spend your freshman year living in campus housing and then decide on an apartment with friends for your sophomore year, you’ll need to rebudget to account for the changes in your expenses.

Use Technology to Your Advantage

Most young people today are digital natives, meaning that they were born into a world where the web already existed and technology was a huge part of their daily lives. For that reason, they’re very comfortable with technology and can use it to their advantage when creating a budget.

Logan Abbott of Wirefly thinks that budgeting apps are the way to go:

“The easiest way to create and stick to a budget is by using technology like apps and websites. Mint and Betterment both provide great budgeting capabilities. Mint is one of the best apps for budgeting, creating a budget and being able to see what your money is being spent on each month.”

Molly Ford-Coates also approves of using apps for budgeting. She says:

“There are great apps for your phone that link to your bank account. You can even set an amount you want to spend in each category. When you are approaching that amount, you will receive a notification. With all that is happening in college, most students will probably find an app the most convenient.”

Steven Byrd of Hearthstone Money says:

“College students are more connected than ever before, and they can use that to their advantage when creating a budget. Apps like Mint, You Need A Budget (YNAB) and DollarBird are all great options. Each one takes a unique approach to daily cash management that students can tailor to their needs and personalities.”

You may want to try out several budgeting apps and see which one you prefer. We agree with our experts that having a budgeting app on your phone is one of the best ways to stick to your spending limits and reach your financial goals.

Open Multiple Accounts

One thing that can make sticking to your budget difficult is having all your money in one account. After all, the money’s there – and is it really that big a deal if you dip into your savings to enjoy a night out with your friends?

Brian Davis of SparkRental recommends having five separate accounts, as follows:

- Checking account for day-to-day expenses

- Savings account for irregular expenses

- Savings account for emergency fund (aim for $1,000 at first, then aim for 2-6 months' expenses)

- Taxable brokerage account

- Roth IRA

Having five accounts might seem like a lot, but we see the value in it. Your emergency fund should be in a place where you can’t touch it unless it’s – you guessed it – an emergency. Your day-to-day expenses should be easily accessible and a checking account with a debit card makes sense.

Investing is a good idea at any age. When you take your investment money and put it into a taxable brokerage account or IRA, it will earn interest and grow far more quickly than it would in a traditional savings account.

Brian goes on to add that college students should “automate their savings and investments to ensure this good behavior happens each month.” Automation is your friend because it takes the decision to save money out of your hands, making it more likely that you’ll stick to your goals.

Be Flexible (but Not Too Flexible)

A common misconception about budgets is that they’re carved in stone. A better way to think of them is that they provide a spending framework. A budget is a tool, not a prison.

Eryn Lueders of Frugal Twins, like some of our other experts, recommends the Mint app for budgeting because of its flexibility. She has this to say about it:

“You can set up individual monthly budget allotments for areas of your life like groceries, shopping, and dining. What is great is Mint will automatically track as you spend in those areas and will notify you once you've hit the spending limit in a category.

Mint doesn't provide a hard and fast category limit so if you do overspend one month in a category, it gives you some grace. Over time, this can help train you to be more aware of the categories where you often overspend and make it easier for you to stick to a budget.”

While we do recommend tracking your spending prior to creating your budget, we also like the suggestion of using a flexible app that will notify you when you go over budget and allow you the flexibility to shift things around if you need to. Budgeting shouldn’t feel like a chore. Instead, it should give you the freedom to meet your financial goals AND live your life at the same time.

Plan for Irregular Expenses

Our final tip to help you stick to your budget in college comes from Clint Proctor of Wallet Wise Guy. He points out:

“One of the things that can make budgeting hard for college students is that their expenses tend to be very irregular. Paying for tuition and buying books and supplies all typically happens within a short period of time at the beginning of each semester. That means for the average student, the majority of his or her financial outflow happens during two short windows of time.

To help college students avoid this situation, it's helpful to divide up the annual cost of your college education by 12. That way it's easy to see how much you need to save each month if you want to be able to pay for your college bill when it arrives.”

The expenses that arise only occasionally can blow your budget or leave you short. The best way to account for them is to do it monthly. By making them part of your regular budget, you can be sure that you have what you need to meet your monthly expenses.

Knowing how to budget money in college isn’t just about paying your expenses. It’s something that will set you up for a lifetime of financial success.

Need some help paying for your college tuition? Click here to learn about Addition Financial’s student accounts!