Any student who plans on attending college understands that it can be very expensive. Even at state schools, tuition can be high. When you add in room and board, the costs can be prohibitive.

The solution for many students and their parents is taking out loans. It’s no secret that student loan debt is something that people carry for years. It can impact your ability to save for retirement and buy a home, among other things.

At Addition Financial, we work everyday with students and their parents to help them budget for college. Here are some tips to help you learn how to pay for college without loans.

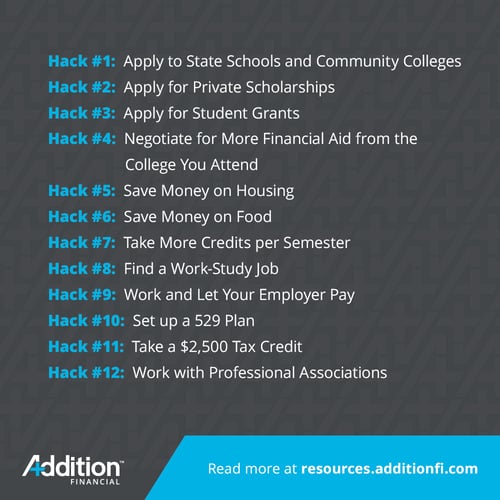

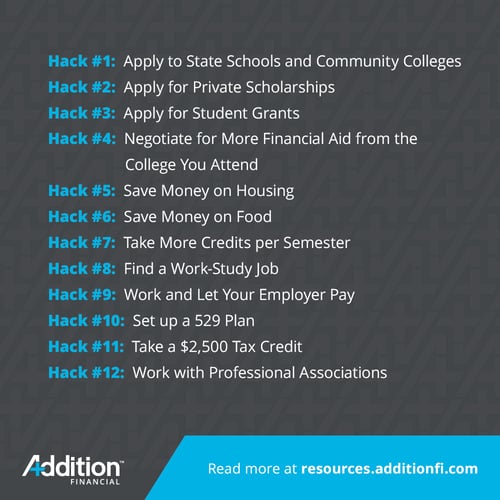

Hack #1: Apply to State Schools and Community Colleges

It’s a common misconception that you must attend a high-priced private college to get a quality education. The truth? You can get a great education anywhere because ultimately, you will get out of college what you put into it.

Instead of applying to expensive schools where you’ll need to take out extensive loans to pay your tuition, focus on less expensive options to minimize your expenses. Keep in mind that in-state schools will cost less than state schools elsewhere. Also, remember that you can start in community college and transfer to another school if that’s what you want.

Hack #2: Apply for Private Scholarships

Scholarships don’t magically appear out of the ether when you’re ready to apply to college. You must seek them out and apply to them. If you’ve got good grades and you choose wisely, you can offset much of your college tuition with scholarship money.

You can find scholarships to apply for here. Cast as wide a net as possible, but make sure you understand the requirements for each scholarship. For example, some scholarships have a GPA requirement that you must meet to maintain your scholarship.

Hack #3: Apply for Student Grants

Grants are another type of educational funding to consider. They are typically awarded by state governments, the federal government and colleges. When you complete your FAFSA application, the information there will be used to determine your eligibility for grants. If you receive financial aid from a college, grant money should be included in your financial aid information.

If your family earns less than $30,000 annually, you may qualify for a Federal Pell Grant. Qualification for state-sponsored grants varies from state to state. You can find a list of Florida student grants and scholarships here.

Hack #4: Negotiate for More Financial Aid from the College You Attend

When you receive a college acceptance letter and a financial aid package, you should compare your financial aid across schools. If you don’t get a free ride, consider picking one or more schools to ask for more money.

That might sound audacious but colleges expect there to be some calculation going on as accepted students try to work out how they will pay for school. The very worst thing that will happen if you ask for more money is that they’ll refuse. In other words, if you don’t ask, you’ll be guaranteed the worst result you would get if you did ask. If you’re wondering how to pay for college, asking for help is a risk worth taking.

Hack #5: Save Money on Housing

For many students, living away from home for the first time is a big part of the thrill of attending college. If you want to know how to pay for college without loans, it’s important to consider housing alternatives that might help you to save money.

Here are some options:

- Attend a local or community college and commute from home.

- Compare the cost of room and board with the cost of living off campus. You may be able to save a lot by renting a small apartment or room.

- Take on a roommate (or two, or three). It’s quite common for college students to band together to save money on a house. If you share with several roommates, you may be able to save hundreds of dollars each month on housing.

If you do intend to live off campus, make sure to crunch the numbers and include your expenses for travel and utilities.

Hack #6: Save Money on Food

You might assume you need to pay for a college food plan while you attend school, but there are alternatives. For example, if you decide to live off campus with friends, you could all chip in on a Costco membership to save by buying food in bulk.

Here again, it’s your job to crunch the numbers and figure out what makes the most sense. Your best option may be to buy the school’s least expensive food plan to make sure you can eat while you’re on campus. Then you can fill in the rest closer to where you live.

.jpg?width=500&name=AF_BlogSummary27-3%20(1).jpg)

Hack #7: Take More Credits per Semester

One of the reasons that college expenses add up is that it takes time to earn a degree. If you carry the minimum required credits per semester, then it will likely take you four full years to graduate.

An alternative that can help you pay for college without loans is to take more credits per semester. If you wanted to graduate in seven semesters instead of eight, you could simply take your total credits required and divide by seven to figure out how many credits you’d need per semester.

If you try this strategy, make sure you can handle the increased workload – particularly if you have a GPA requirement to maintain your scholarships. You won’t save money per credit, but you will save on auxiliary expenses such as room and board.

Hack #8: Find a Work-Study Job

If you’re prepared to work while you attend school, then it may be worth applying for your school’s work-study program. Some colleges build work-study jobs into their financial aid packages. It’s typical for there to be a dollar amount which will signify the maximum you can be paid.

The payments for the work you do will come directly to you. You can use the money you earn to offset expenses such as your phone bill, books or entertainment. You can also supplement your work-study job with another part-time job or a paid internship if you choose.

Hack #9: Work and Let Your Employer Pay

Some employers have tuition reimbursement programs for their employees. The most generous employers will pay for any degree, but some will pay only if the degree is relevant to the employee’s job.

If you are comfortable diving right into work after high school, you can seek out an employer that offers tuition reimbursement. You may need to put in some time (six months to a year) to qualify, but once you do, you can attend school while your employer shoulders the expenses. This option isn’t for everybody, but it is a way to get your education fully funded.

Hack #10: Set up a 529 Plan

If you still have some time before your high school graduation, you should consider setting up one or more 529 savings plans. A 529 plan allows you or people contributing on your behalf to fund the plan in pre-tax dollars, although some states offer a tax credit instead. You can set up multiple plans in multiple states if you choose.

A creative option to increase your funds is to ask friends and relatives to contribute money to your plan in lieu of birthday, holiday or graduation presents. Since money in the 529 plan can be invested, it’s possible to accumulate a nice sum even if you get a late start.

Hack #11: Take a $2,500 Tax Credit

Are your parents paying part of your college tuition? If they are, they may qualify for the American Opportunity Tax Credit, which offers up to a $2,500 tax credit per student each year. A tax credit comes directly off your tax bill instead of your taxable income like a tax deduction would.

The tuition tax credit applies to families earning less than $80,000 individually or $160,000 if married filing jointly. Best of all? If the total credit would bring your tuition down to zero, you’ll get up to 40% of the remaining amount of the credit – up to $1,000 – refunded to you.

Hack #12: Work with Professional Associations

Are you planning to go into a field that typically has a difficult time attracting people? If you are, then you may want to consider approaching local and national professional organizations to see if they offer college assistance.

You may find that professional organizations are willing to provide scholarship money, grant money and other forms of financial support to students majoring in their field or a related field. Keep in mind that you should look for specialized subgroups as well. For example, an organization of women in the STEM fields might provide support to female students in STEM.

If you need to know how to pay for college tuition without loans, the hacks we’ve listed here can help you reduce your tuition. The more open you are to the options – and the more creative you’re willing to be – the easier it will be to earn your college degree without accruing debt.

Need some guidance figuring out how to pay for college? Click here to learn how Addition Financial can help!

.jpg?width=500&name=AF_BlogSummary27-3%20(1).jpg)