Table of Contents

- Step 1: Start with Income – The Foundation of Your Tax Return

- Step 2: Don’t Forget Deductions and Tax Credits

- Step 3: Major Life Changes? Tax Law Says They Matter

- Step 4: Collect Your Credit Union & Financial Account Info

- Step 5: Organize Before You Itemize

- Step 6: Ask for Help (It’s What Professionals Are For)

- Step 7: Make Next Year Easier with Addition Financial

Let’s be honest, tax season doesn’t exactly spark joy. Between the talk of tax laws, credits, deductions, and that one W-2 that’s always hiding under a couch cushion, it’s easy to feel overwhelmed.

But what if tax prep didn’t have to be stressful? What if this year, you could cruise into tax filing season feeling calm, organized, and maybe even, dare we say, confident?

At Addition Financial, we believe financial wellness includes making complex things simple. So before you start your tax preparation journey (or panic-search for “where’s my 1099?”), Let’s take a deep breath and gather everything you’ll need. Think of this as your friendly, no-stress guide to the tax-time checklist you’ll wish you had last year.

Step 1: Start with Income – The Foundation of Your Tax Return

Ask yourself: Do you have all your income statements ready?

This is where your tax prep journey begins. The IRS (and your tax professional) will want to see documentation of every dollar you earned from your 9-to-5 job to your side hustle or savings account interest.

Here’s what to gather:

- W-2 forms from each employer. (Employers are required to send these out by January 31.)

- 1099 forms for freelance work, gig income, or contract jobs (1099-NEC or 1099-MISC).

- 1099-INT or 1099-DIV forms for interest or dividends — including those from your Addition Financial savings accounts or certificates.

- 1099-G for unemployment income or state tax refunds.

- Social Security benefit statements (SSA-1099), if applicable.

You can often find your 1099-INT forms directly in your online banking dashboard, no mailbox hunt required.

Step 2: Don’t Forget Deductions and Tax Credits

Ask yourself: Are you missing out on deductions or credits you could claim?

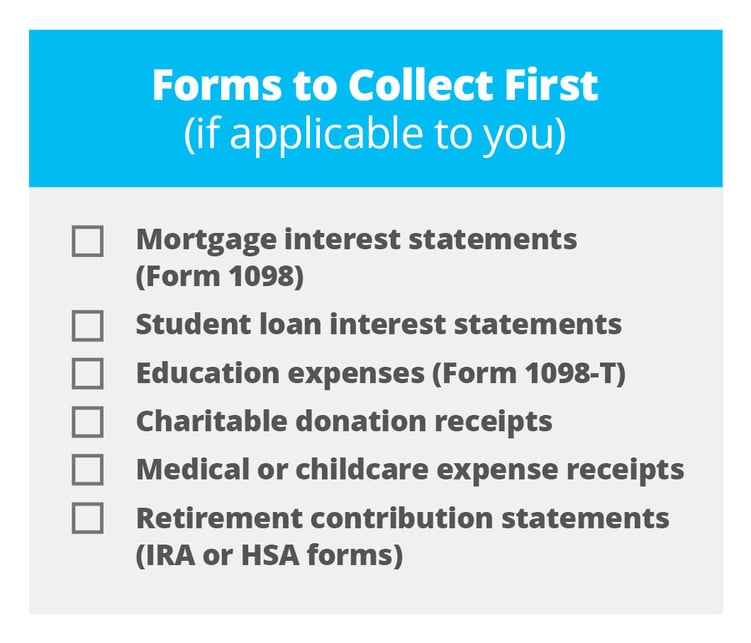

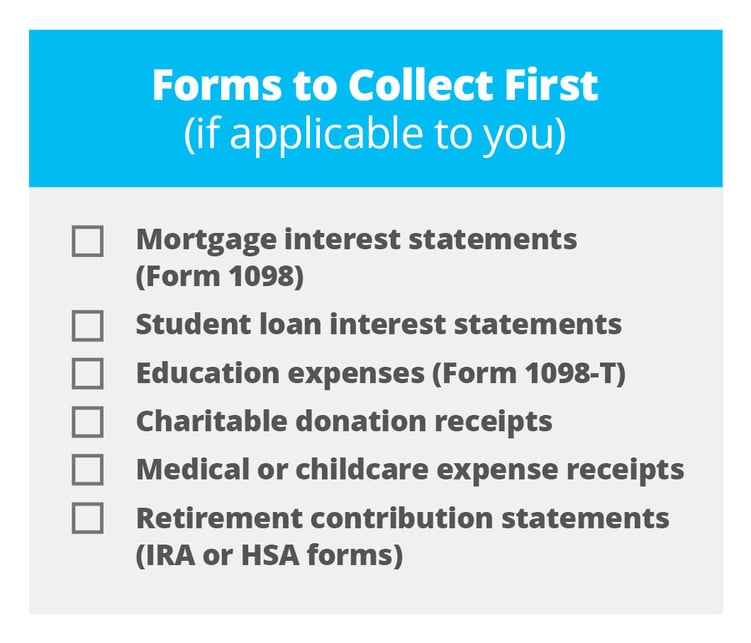

This is the fun part where you get rewarded for being financially responsible (and sometimes just for being human). Tax credits and deductions can reduce how much you owe or increase your refund, so keeping the right paperwork is key.

If you have kids, check whether you qualify for the Child Tax Credit or other family-related benefits. These can make a big difference on your tax return.

Keep a folder (digital or physical) for all your receipts. Even if you don’t itemize every year, having them ready will make next year’s tax planning much easier.

Step 3: Major Life Changes? Tax Law Says They Matter

Ask yourself: Did your life change this year, and have you documented it?

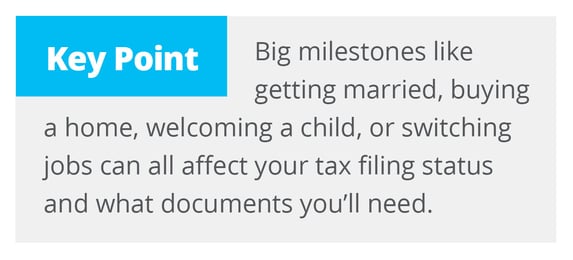

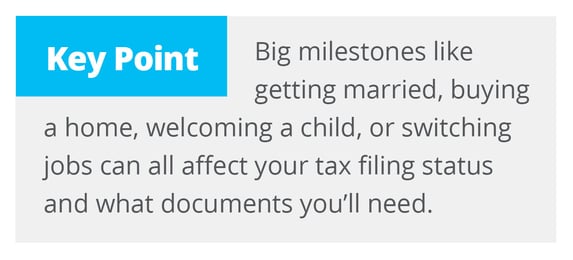

Life moves fast, and often, tax laws move right along with it. Big milestones like getting married, buying a home, welcoming a child, or switching jobs can all affect your tax filing status and what documents you’ll need.

If any of these apply, gather:

- Marriage or divorce certificates

- Birth certificates for new dependents

- Adoption paperwork

- Home purchase or sale closing documents

- Property tax records

- New job offer letters or relocation expense records

Your tax professional can help you navigate how these changes affect your tax return. But starting with organized paperwork will make that conversation smoother and cheaper, since less time sorting means less time billed!

Step 4: Collect Your Credit Union & Financial Account Info

Ask yourself: Have you downloaded your year-end statements from your credit union accounts?

Your credit union accounts hold important tax documents that reflect your financial activity. Make sure you gather:

- Year-end statements for checking, savings, and investment accounts

- Mortgage or auto loan interest forms

- Contribution statements for IRAs or HSAs

- Estimated tax payment records (if you’re self-employed)

All of these can be downloaded in minutes online. Consider creating a folder on your desktop titled “2026 Taxes.” It’ll make you feel like you’ve got your life together.

Step 5: Organize Before You Itemize

Ask yourself: What’s your plan to keep tax documents organized this year (and next)?

Here’s where we turn chaos into calm. Once you’ve gathered your tax documents, put them into categories either in a folder or a digital drive. Label them something simple like “Income,” “Deductions,” and “Life Events.”

You’ll thank yourself later when your tax professional asks for that one form and you can actually find it.

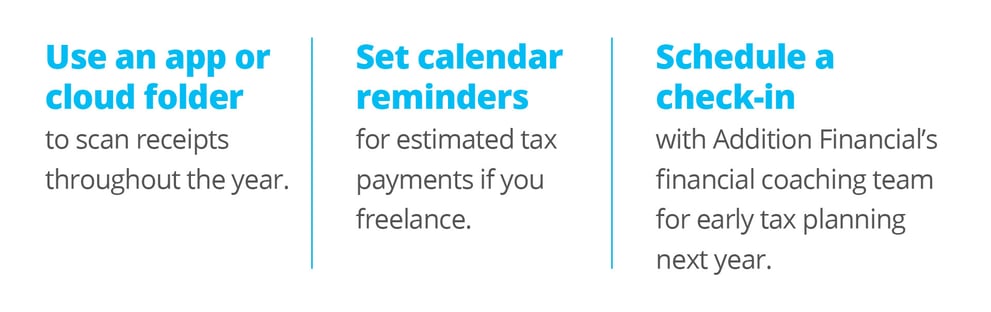

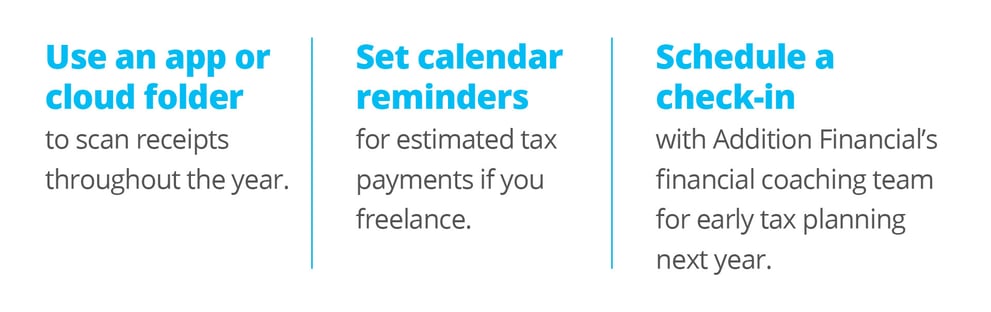

Bonus ideas:

Think of this as spring cleaning for your finances, but instead of decluttering closets, you’re decluttering stress.

Step 6: Ask for Help (It’s What Professionals Are For)

Ask yourself: Have you scheduled time to review your documents with a financial coach or tax professional?

Even the most organized taxpayers can benefit from a little expert help. A tax professional can help you navigate changing tax laws, maximize your tax credits, and ensure you’re filing correctly.

If your return is simple, consider using the IRS Free File program. It’s a great way to file federal taxes at no cost. If your situation is more complex (multiple income streams, dependents, or self-employment), professional guidance can save you both time and money.

Bring your checklist of documents when you meet your preparer. It shows you’re organized and helps them file your return faster.

Step 7: Make Next Year Easier with Addition Financial

Ask yourself: What could you do today to make next year’s tax season even easier?

Once you’ve filed your return and taken a victory lap, use that momentum! A little prep now will make next year’s tax prep practically effortless.

Try this:

- Create a year-round tax folder (digital or paper). Add any donation receipts, major purchases, or financial changes as they happen.

- Set quarterly reminders for estimated tax payments if applicable.

- Review your withholding. Too much means a big refund (but smaller paychecks), too little could mean a surprise bill.

- Schedule a mid-year financial checkup with Addition Financial. We can help you review your goals, saving strategies, and upcoming tax opportunities.

The goal? Replace tax-time panic with confidence and maybe even a sense of accomplishment. If you are looking for a way to start organizing now, try our resource, “The Rebalance Report: Reflect, Refresh & Plan Your Money Goals.” This will help you finish out the year feeling more prepared.