Going away to college is a major life event. Even students whose parents have prepared them well for the realities of adulthood can struggle.

At Addition Financial, we understand the importance of financial planning for college students. Learning the ins and outs of personal finance is a must. The more educated you are about the basics of personal finance for college students, the more likely it is that you will stick to a budget and set yourself up for financial success later in life.

With that in mind, here’s what you need to know about personal finance and financial planning – before you go away to college.

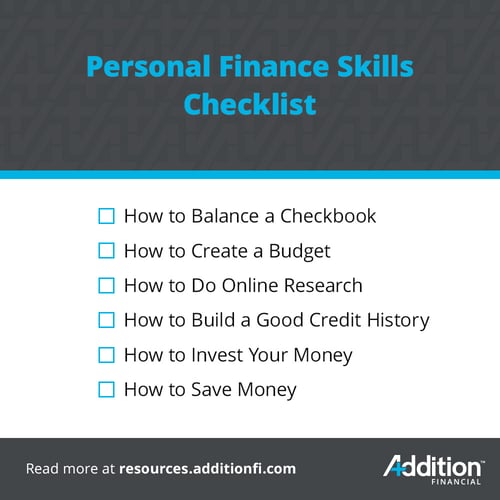

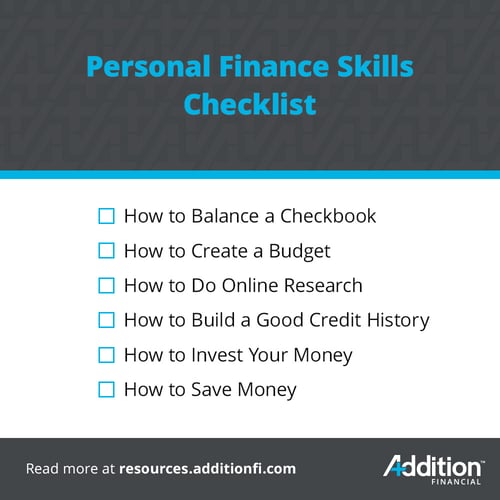

Personal Finance Basic Skills

The first thing you need to do to prepare for going away to college is to acquire some personal finance basic skills. We asked financial experts which basic skills they thought college students should have. Here are some of their responses:

- How to read a bank statement. Learning what to look for in your account statement can help you catch mistakes like double charges or fraud.

- How to create a budget. Budgeting is a necessary skill regardless of your income. Even if you earn a lot of money, creating a budget can help you live within your means and achieve your financial goals. For college students on a limited income, budgeting is essential.

- How to do online research. Before you make any purchase, it’s a good idea to research the product or service you’re buying and the company providing it. Research is one of the best ways to save money and stick to your budget.

- How to build a good credit history. Your credit score is important because it plays a role in many aspects of life. Everything from getting a credit card to renting an apartment to beating out other candidates for a job can be tied to your credit score. It’s important to understand what goes into calculating your credit score.

- How to invest your money. While most high schoolers and college students aren’t thinking about the stock market, they should at least understand the basics of investing and how compound interest helps them accumulate wealth over time.

- How to save money. One of the most common misconceptions about saving money is that you can do it by making small spending cuts such as bringing coffee from home. The truth is that top-down savings will be far more lucrative in the long run. We’ll talk more about that in the next section.

We wish that schools taught personal finance basics as part of the general curriculum but most do not. If you don’t have the basic skills you need, you should learn them as soon as possible. At Addition Financial, we’re happy to help our clients with basic personal finance.

Personal Finance Common Sense

A big part of managing your finances responsibly is understanding the role that common sense plays in spending, saving and investing. Learning the basics can help you to manage financial stress. Let’s look at a few examples as they relate to top-down savings.

Choosing a College

You can choose where to attend college. There’s a lot of attention on high-profile private schools with high tuition. It’s undeniable that people get excited when they hear someone’s been accepted into an Ivy League university – but is that really the best place for you to go?

In many cases, the answer is no. You can save thousands of dollars – possibly even tens of thousands – by attending a lower-priced state school or community college. You can obtain a quality education anywhere if you put in the work. This is an example of an area where a little bit of common sense, and a focus on top-down savings, can make a big impact on your financial health.

Buying a Car

Another example of top-down savings involves buying a car. You can, of course, choose to buy a new vehicle in a fancy model that costs a lot of money. It will get you around – and it will also saddle you with thousands of dollars of debt.

By choosing a used car that’s reliable and affordable, you’ll get the same benefits as with a new car minus the debt. Since new cars depreciate the instant you drive them off the lot, buying a used car in good condition is a far more sensible option.

Finding Creative Ways to Pay for College

A lot of college students take the path of least resistance to pay for school. That means they:

- Apply for one or two scholarships

- Apply for general financial aid

- Take out student loans to pay for the remaining balance

A more creative approach would be one that assumes you can find ways to offset all (or nearly all) of the expenses of attending college. That might mean:

- Applying for dozens of scholarships

- Applying for state and federal grants

- Seeking out financial assistance from professional associations

- Enrolling in work-study programs

- Taking advantage of employer tuition reimbursement

The bottom line here is that student loans may not be necessary. If you can graduate without debt, you should do it – even if it means attending a community college and working your way through school.

.jpg?width=500&name=AF_BlogSummary27-8%20(1).jpg)

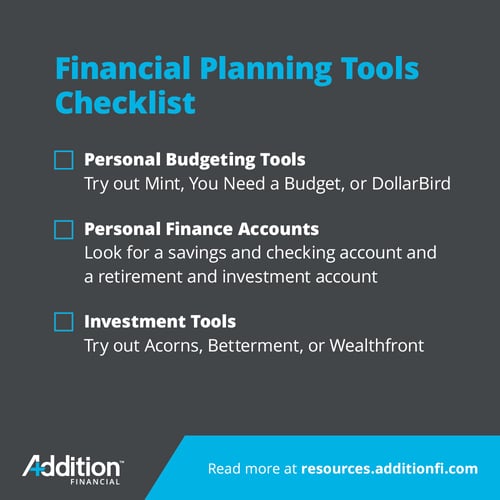

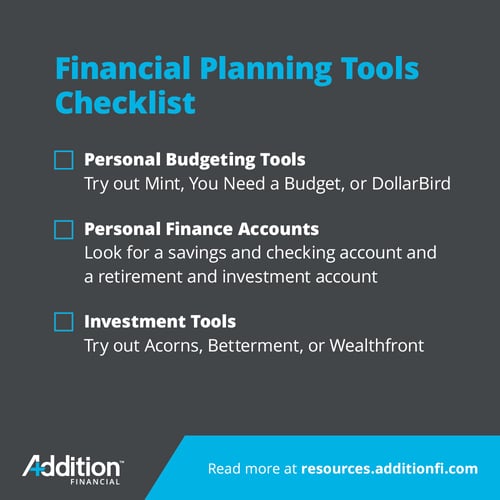

Financial Planning Tools

Part of managing your personal finances responsibly is having the tools that will allow you to do so. Since technology is such a big part of our lives, it makes sense to take advantage of it and use software and apps to help you with financial planning.

Personal Budgeting Tools

Since budgeting is such an important part of financial planning for college students, let’s start there. Here are some budgeting apps that we (and our favorite financial experts) recommend.

- Mint – Mint is a free budgeting app. You can use it to set up monthly budget allotments by category and link it directly to your bank and investment accounts. This is the tool that was mentioned most frequently by our financial experts.

- You Need a Budget – This is another great tool that allows you to personalize your budget according to your needs. It’s not free like Mint, but they do offer a 34-day free trial and affordable pricing.

- DollarBird – DollarBird is a calendar-based budgeting app that has a free plan with an upgrade for only $3.33 per month.

Addition Financial has a free monthly budget calculator to help you get started. It doesn’t track your expenses, so it may be best to start with our calculator and then use an app to help you track your daily spending and expenses.

Personal Finance Accounts

The bank and investment accounts you open should play a significant role in helping you to manage your money effectively. Here are some examples of accounts you may want to have:

- A regular checking account for your expenses

- A regular savings account for unexpected costs

- An emergency savings fund

- A college savings fund, such as a 529 fund

- A retirement account, such as an IRA or 401(k)

- An investment account with your bank or an online brokerage

Just as important as opening the right accounts is choosing the right credit union or bank. Ultimately, you need a financial institution that will work with you to help you achieve your financial goals. There are advantages to choosing a credit union instead of a bank. For example, at Addition Financial, we have an array of online resources and calculators available to our members.

Investment Tools

Investing some of the money you save now is the best way to build financial security for your future. Even if you don’t have a lot to invest, you can still start investing and take advantage of compound interest to build wealth.

Here are some of our favorite investment tools:

- Acorns – Acorns allows you to begin investing your money with as little as $5. You can use it to set aside change from your daily transactions, creating an automated stream of savings and investments. Their plans start at $1 per month.

- Betterment – Betterment isn’t just for investing. They have budgeting tools as well. You can start investing with as little as $10 and use the app to move your money around, track investments, and more. Their investing and retirement accounts have a flat fee of 0.25% per year.

- Wealthfront – Wealthfront is a robo-advisor that comes highly recommended. They have plans to help you save and invest for a variety of goals, including homeownership, college, and retirement. You can use their financial planning tools for free and like Betterment, their investment services cost 0.25% per year.

You may prefer to work with a financial advisor. At Addition Financial, we offer an array of retirement accounts, including traditional and Roth IRAs. Our members can choose to speak with one of our financial advisors as well.

If you’re going away to college, you should avail yourself of any personal finance education and tools you can find to ensure that you spend your money wisely. Financial planning is not something you should leave to chance – even when you’re just starting out.

Need some assistance with your financial planning for college? Click here to learn how Addition Financial can help!

.jpg?width=500&name=AF_BlogSummary27-8%20(1).jpg)