When the New Year’s confetti settles, many of us turn our attention to what we want to accomplish in the year ahead. That means making resolutions and setting goals.

At Addition Financial, we consider it our responsibility and our honor to help our members achieve their financial goals. One of the most common questions we get at this time of year is:

“What are your financial tips for the new year?”

We asked some financial experts for their best financial tips. Keep reading to learn about them – and to learn about our favorite New Year’s savings plan.

Financial Tip #1: Do a Financial Self-Audit

Our first tip comes from Logan Abbott, who runs Wirefly.com, a website that makes it easy to compare the costs of common services such as insurance, cell phone plans and cable. He suggests starting the new year with a complete audit of your finances.

An audit might sound intimidating, but it doesn’t need to be. We like this tip because it’s highly practical and something that can help you in every area of your finances. Here are the steps Logan suggests for your financial audit.

- First, make sure you are not carrying any large credit card balances that you could pay off. As Logan says, “If you can pay it off, then go ahead and pay it off.” If you can’t pay the balances, you should consider applying for balance transfer card with a low introductory APR.

- Evaluate what you’re paying in monthly expenses for common services. Wirefly makes it easy to take this step and according to Logan, the average Wirefly user saves 30% by switching providers.

- Third, go through your credit card statement or bank statement and look for recurring charges. It’s very common for people to sign up for monthly subscriptions (or free trials that turn into monthly subscriptions) and forget about them. Your audit will give you the opportunity to weed out unwanted subscriptions and cancel them, potentially saving a significant sum over the course of the year.

You can combine your audit with using some of our online calculators to get a handle on your finances.

Financial Tip #2: Use the 70/20/10 Plan

Our next tip comes from Ilene Davis, CFP®, MBA, and the author of Wealthy by Choice: Choosing Your Way to a Wealthier Future. She suggests using the 70/20/10 plan to reduce expenses and build wealth at the same time. Here’s how it works:

- Work out a budget that allows you to live on 70% of your net income. That may mean trimming expenses, cutting back on luxuries and finding ways to live more frugally in general.

- Use 20% of your net income to pay off your debt. Ilene says to pay the minimum on all cards except “the highest interest rate debt.” For that one, you should pay as much as you can afford every month and then roll the extra payments into the card with the next highest interest rate. We’ve written about this method, which is sometimes referred to as the avalanche method, before.)

- Use the final 10% of your net income to invest for retirement and build wealth.

If you’re someone who has a hard time setting money aside for the future, this strategy is one that can work very well. We asked Ilene for specific tips to help people implement the 70/20/10 strategy. She had two:

- Get a 3x5 notebook (or use a spreadsheet) and write down every single penny spent and what you spent it on. She said this forces people to be accountable for their spending.

- Every time you go to spend money, ask yourself if spending it today is more important than what the same money could be worth in the future.

Ilene’s advice is useful if you haven’t done much to save for retirement. You may need to make some sacrifices to live within 70% of your income, but this plan is practical and can help you get out of debt and save for the future.

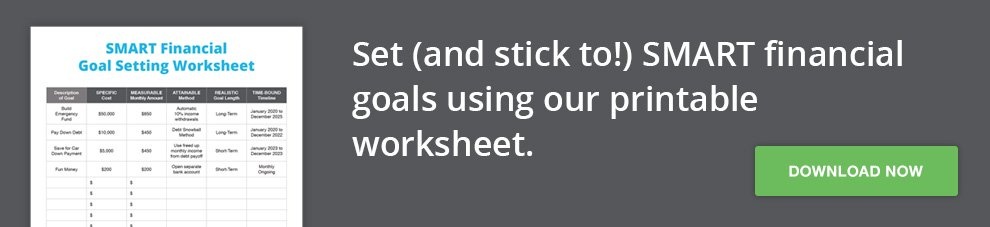

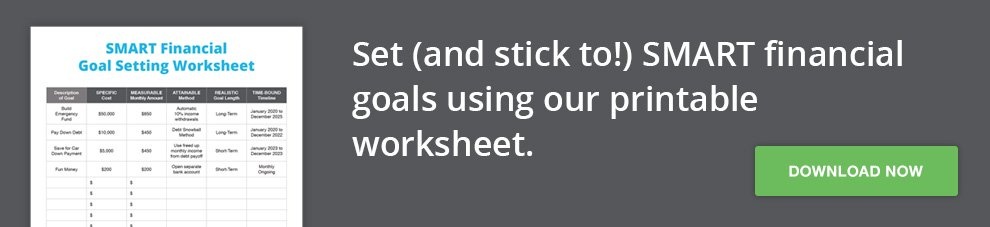

Print Now: The SMART Financial Goal Setting Worksheet

Financial Tip #3: Start Investing Your Money

Investing is a topic that we talk about a lot, and yet it’s one that can still be intimidating to people who have never invested their money before. The tip we received from Miguel A. Suro, a lawyer who writes about personal finance at The Rich Miser, is this:

“One huge step to improve your finances in the long run is to start investing! The stock market has an average annual return of about 10%, making it one of the best wealth-generation vehicles an individual can access.”

Miguel points out that only about 55% of Americans own stocks as of 2019, a number that marks only a 1% increase from 2018. If you’re part of the 45% that doesn’t own any stocks, it may be time to start investing with an eye toward making long-term gains.

Here are Miguel’s tips for people who want to get started in the stock market in 2021:

- Open an account with a robo-advisor that will invest for you. Robo-advisors are algorithm-driven financial advisors that take the information investors provide them about their investment plans, income and goals, combine it with data about the stock market, and make investments on the investor’s behalf. Typically, the fees for robo-advisors are lower than for a broker, making them an affordable option for investors who are just getting started.

- Set up an automatic transfer from your checking account to your investment account. The amount can be as little as $10 or $15 per pay period. The key is to get started and be consistent. You can always increase the amount you invest later.

We would add that you should research robo-advisors thoroughly before choosing one, making sure you understand their fees and the basics of how they choose stocks before you commit. You may want to consider meeting with a financial advisor to figure out an investment plan. We also think you should monitor your investments closely to get a feeling for the ebb and flow of stock prices. Stock investment is a much better long-term financial strategy than a short-term one.

Financial Tip #4: Take Advantage of Free and Inexpensive Entertainment

Our next tip comes from Gladice Gong, a personal finance blogger at Earn More Live Freely. Her tip has to do with saving money on entertainment in the new year. She says:

“My favorite savings strategy for the New Year is to learn to love the library and museums. So, instead of spending a lot of money on theme parks and playgrounds, you can take your children to visit the library and museums.”

We love this suggestion. Libraries often have free programs, events and workshops for kids. Many branches have bulletin boards where they display upcoming events. Or, you can check the website of your local branch for information.

We love this suggestion. Libraries often have free programs, events and workshops for kids. Many branches have bulletin boards where they display upcoming events. Or, you can check the website of your local branch for information.

The tip we’d add is that many libraries make free passes for local attractions available to cardholders. For example, you might be able to get free passes to a museum, aquarium or zoo, which can be fun for your kids while also being educational. Museums sometimes have free events and exhibits, or even waive the admission fee on certain days.

Gladice recommends scheduling your museum and library visits in advance and putting them in your calendar. That way, you’ll know what you have planned, and the kids will know they have outings in their future.

Financial Tip #5: Our Favorite Savings Plan

Let’s close with a financial tip from our savings experts at Addition Financial. We recognize that saving money can be a challenge when you’re living on a budget. We think that the best new year savings plan is to make saving a habit.

What we’re talking about is automaticity. Automaticity is the brain’s ability to perform tasks automatically without engaging the decision-making process.

Here are some tips to help you build automaticity around saving money:

- Split your direct deposit between your checking and savings account every pay period. (Alternative: transfer money to your investment account every pay period as noted above.)

- Empty your purse or wallet of coins every day. Periodically, take the coins to a CoinStar machine and choose the Amazon gift card option to avoid paying fees.

- Turn windfalls into savings. If you get a raise and you’re living comfortably on what you were making before the raise, take the increase in salary and roll it into savings or investments. The same can go for your holiday bonus!

Once you become accustomed to saving money, it will become second nature to you. We think you’ll be amazed at how quickly your savings can accumulate using this method.

Coming up with financial tips for the new year is our way of helping our Addition Financial members reach their financial and savings goals. We hope you’ve found the information here to be useful and inspiring!

To learn how our Addition Financial savings accounts can help you reach your savings goals, please click here.

We love this suggestion. Libraries often have free programs, events and workshops for kids. Many branches have bulletin boards where they display upcoming events. Or, you can check the website of your local branch for information.

We love this suggestion. Libraries often have free programs, events and workshops for kids. Many branches have bulletin boards where they display upcoming events. Or, you can check the website of your local branch for information.