Table of Contents

- Review and Reset Your Financial Baseline: Your Year-End Reflection

- Build a Realistic Comeback Budget: Planning Your New Year Countdown

- Prioritize Debt Reduction: Making Your New Year’s Resolutions

- Your Financial Comeback Starts Now

As the year winds down, many people start reflecting on their financial journey by celebrating wins, acknowledging challenges, and planning for a stronger future. If this year brought financial setbacks, rising credit card balances, or stressful calls from a debt collector, you’re far from alone. Millions of Americans find themselves facing debt at the end of the year, especially after holiday expenses, unexpected bills, or shifts in cash flow.

But here’s the good news: the end of the year is one of the most effective times to begin a financial recovery. With new goals on the horizon and the opportunity to reset your habits, you can turn this moment into a powerful, fresh start. Whether you’re managing collection notices, exploring debt settlement, or simply wanting to feel more in control of your finances again, these three year-end strategies are designed to help you move confidently from debt to recovery.

Review and Reset Your Financial Baseline: Your Year-End Reflection

Just as many people spend December reflecting on their personal growth, highlights, and challenges from the past year, your finances deserve the same thoughtful attention. A year-end financial review acts as your personal “closing ceremony” or a chance to look back honestly so you can move forward intentionally.

Why a Year-End Review Matters

Financial setbacks don’t happen in isolation. They’re often the result of changes in income, unexpected emergencies, overreliance on credit cards, or simply losing track of spending during busy seasons. Taking time to review your finances helps you:

- Identify where spending exceeded expectations

- Understand which patterns led to increased debt

- Recognize which bills or accounts have slipped into collection

- Spot errors on your credit report

- Determine whether you need credit counseling, debt management, or other support

Start by gathering a complete view of your finances: bank statements, credit card bills, loan summaries, and your credit report. This gives you a clear baseline of your debt, cash flow, credit score, and obligations. You may be surprised at how much clarity you gain simply by compiling everything in one place.

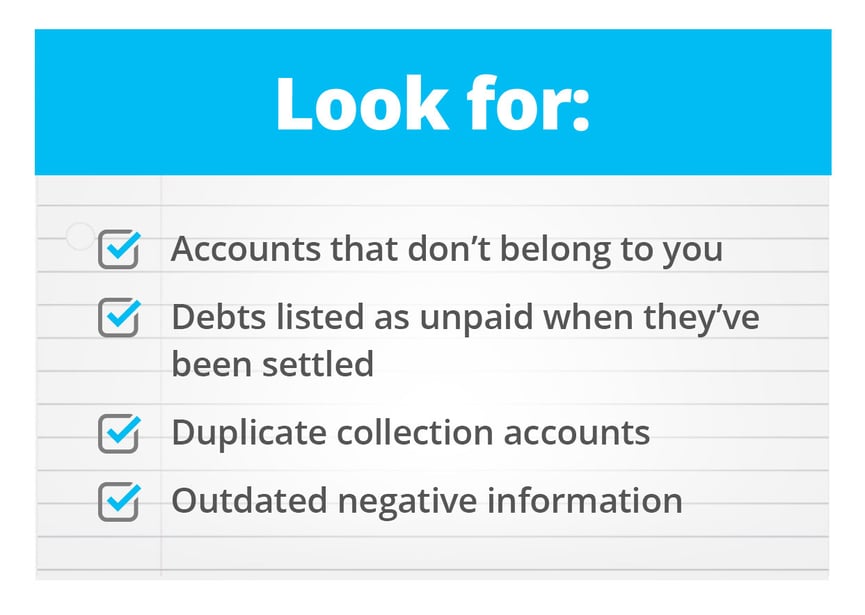

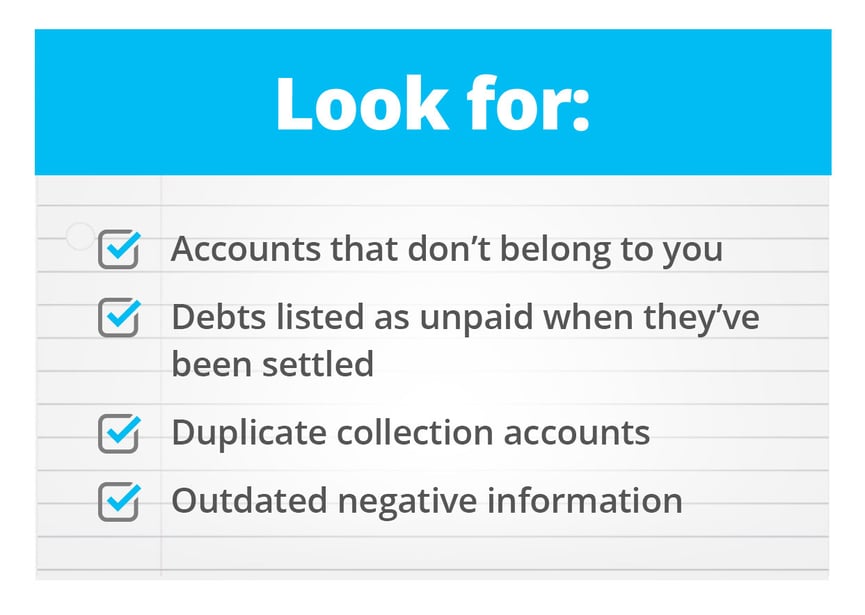

Take Another Look at Your Credit Report

Year-end is an ideal time to review your credit report for inaccurate information, especially if you’ve faced any kind of debt recovery or debt collection action this year. Errors aren’t just frustrating; they can lower your credit score and complicate your financial comeback.

A clean and accurate credit report gives you a stronger foundation for recovery, and Addition Financial can help you interpret your report and understand what to do next.

Think of this as your financial “year in review,” similar to reflecting on accomplishments, challenges, and lessons learned before stepping into a new year with renewed purpose.

Build a Realistic Comeback Budget: Planning Your New Year Countdown

Once you’ve reflected on your financial year, it’s time to shift into planning mode. A comeback budget isn’t just about restricting spending; it’s about aligning your money with your goals so you can regain control and build momentum.

Just as you might prepare for a New Year’s countdown, setting the stage, gathering what you need, and anticipating the moment, you can prepare your finances for a fresh start.

The Power of a Comeback Budget

A comeback-focused budget should address:

- Your essential expenses

- Minimum required debt payments

- Extra payments toward high-priority debts

- Seasonal obligations (holiday expenses, travel, insurance renewals)

- Any upcoming changes to income or cash flow

This kind of budget helps you reduce reliance on credit cards, avoid new financial setbacks, and create room to chip away at existing debt.

Look for Year-End Cash Flow Opportunities

The end of the year often brings unexpected or irregular income: holiday bonuses, cash gifts, commissions, or overtime pay. Even small amounts can create meaningful progress toward debt relief when applied strategically.

If you’re expecting a tax refund, consider this part of your comeback plan as well. While it’s tempting to use these funds on discretionary spending, applying a portion to debt can significantly reduce interest paid over time and accelerate your financial recovery.

Consider Professional Guidance

If your debt feels overwhelming, meeting with a certified credit counseling professional can help you explore structured options like debt management, where payments are consolidated into one predictable monthly amount. If you’re unsure whether debt settlement or bankruptcy is appropriate, a counselor can help you understand the implications on your credit score, long-term cash flow, and financial goals.

This budgeting phase is the financial equivalent of preparing for the New Year’s Eve countdown, organizing your priorities, and setting the stage so your next chapter opens with intention and confidence.

Prioritize Debt Reduction: Making Your New Year’s Resolutions

When the clock strikes midnight on New Year’s Eve, people all over the world set resolutions, promises to improve their health, habits, and lifestyle. You can bring that same optimism and clarity to your financial life.

This step is about turning intention into action.

Choose a Debt Reduction Strategy That Fits You

There is no one-size-fits-all approach to debt reduction. Your strategy should reflect your goals, your cash flow, and your emotional needs around financial stress.

Common approaches include:

- Debt Snowball: Focus on paying off the smallest balances first. Great for building momentum.

- Debt Avalanche: Target debts with the highest interest rates to save the most money long-term.

- Hybrid Approach: Use a combination of both to stay motivated while being financially strategic.

If you’ve been contacted by a debt collector or if multiple accounts have been charged off, prioritize those debts that carry the most consequences or the highest interest costs.

Make Use of Year-End Financial Boosts

Extra income at the end of the year can help reduce principal balances, lower your total interest burden, and improve your credit score faster. Even $50 or $100 applied to a credit card balance can shift your financial trajectory.

This is also a perfect moment to formalize your “financial resolutions,” such as:

- Paying down a specific credit card by spring

- Rebuilding your emergency fund

- Reducing total debt by a set percentage

- Improving your credit score by year-end

- Ending the cycle of debt collection calls

Your resolutions should motivate you, not overwhelm you. Small, consistent steps compound over time. Treat this as the moment you commit to financial goals in the same spirit as New Year’s resolutions: ambitious, hopeful, and focused on long-term improvement.

Your Financial Comeback Starts Now

Financial setbacks can feel discouraging, but they don’t define your future. The end of the year is your opportunity to pause, reflect, and take meaningful steps toward a stronger financial foundation. By reviewing your financial baseline, crafting a realistic comeback plan, and committing to intentional debt reduction, you set yourself up for progress that continues well beyond January 1.

At Addition Financial Credit Union, we’re here to guide you every step of the way, from understanding your credit report to exploring debt management, credit counseling, and other tools for long-term financial well-being. If you haven’t looked at our current featured resource, “The Rebalance Report: Reflect, Refresh & Plan Your Money Goals,” it’s never too late to get started and look forward to what comes next in your financial journey.

Let this year end with hope, and the next begin with progress. Your comeback story starts today.