Buying a home is the biggest purchase most of us will make in our lifetimes. For that reason, the topic of mortgages is one we spend a lot of time discussing, both internally and with our Addition Financial members.

When we recently asked our members to tell us about the most surprising financial myths they had heard, home buying myths and mortgage myths were mentioned frequently. We also reached out to some local financial experts to get their advice on debunking these rumors. We think it’s crucial to understand the truth about mortgages because inaccurate or misleading information can hinder you when the time comes to buy a home.

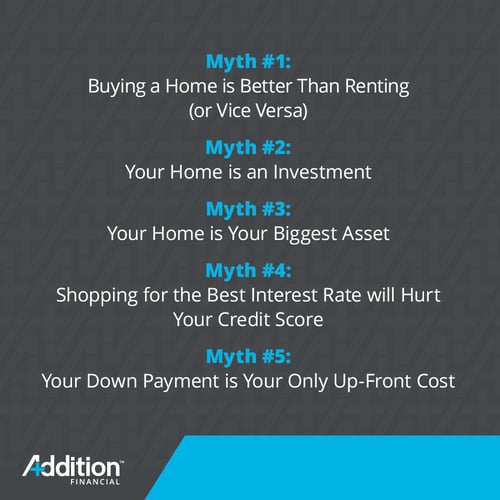

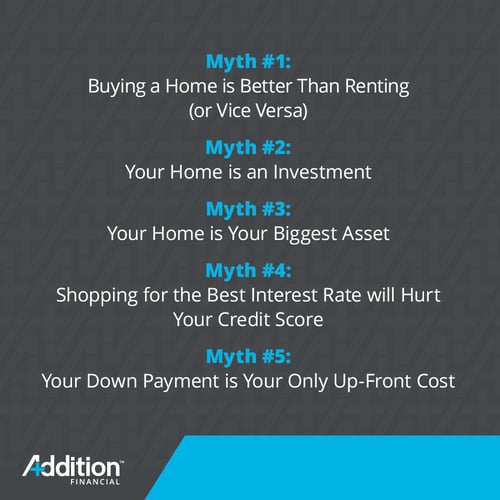

Here are the most common home buying and mortgage myths we’ve heard – and the truth behind them.

Buying a Home is Better Than Renting (or Vice Versa)

We want to start with a pair of home buying myths that go together. By far the most common responses we got were:

- It’s better to buy a home than to rent; and,

- It’s better to rent than to buy a home.

It doesn’t surprise us much that these two contradictory home buying myths came up because they are both persistent. For decades, the dream of homeownership was one that loomed large for most people. The thing that makes these opposing myths dangerous is that they are both true some of the time, and both false some of the time. There’s no one-size-fits-all answer.

Let’s start with buying a home. It might be better than renting in some cases because:

- You won’t need to worry about unexpected rent increases.

- You’ll have a sense of permanence and stability that you might not have if you rented.

- You can deduct some of your mortgage interest on your federal tax return.

- While you’ll be paying mostly interest at first, over time, you will build equity in your home.

- You can do anything you want to add value to your home, including remodeling.

- Many people feel intense pride of ownership when they buy a home.

Depending on your financial circumstances, buying a home may be the best option for you. However, there are circumstances when people might be happier (and financially better off) renting a place to live, instead. Renting offers the following benefits:

- When you rent, you won’t be responsible for upkeep and repairs the way you would if you owned a home. That means your monthly expenses are (mostly) predictable.

- It’s easier to relocate for a job or opportunity than it is when you own a home.

- You aren’t required to pay property taxes.

- Contrary to popular belief, renting isn’t equivalent to throwing money away. You get a place to live in return for the rent you pay.

The upsides of each option point to potential risks as well. With homeownership, you will be responsible for repairs and maintenance. If a tree falls on your house or your pipes leak, there’s no landlord to call. The responsibility (and the expense) all fall on your shoulders.

Likewise, if you rent, you’re at the mercy of your landlord when your lease is up for renewal. If they decide to increase the rent, you’ll need to pay what they ask or move.

The bottom line is that your individual financial circumstances dictate which option is best for you.

Test Yourself Now: The Money Myths Buster Quiz

Your Home is an Investment

Our next myth comes from Brian Davis, a real estate investor and co-founder of SparkRental and a contributor to BiggerPockets, Money Crashers and RETipster. He says:

“Another dangerous money myth is that your home is an investment. While it's true that residential real estate tends to appreciate over time, it doesn't always, and it usually doesn't appreciate faster than stocks. But homebuyers use that logic to justify overspending on their home and paying more than they should, because it's an investment.”

This home buying myth is an amazingly persistent one and it ties directly to the myth that buying is always better than renting. He points out why this myth isn’t true:

“Housing, like food and transportation, is an expense. The more you spend on housing, the less you can put toward true investments like stocks, bonds and investment real estate chosen specifically for its returns, not the countertop finish in the kitchen. Housing may be a necessary expense, but it's still an expense.”

When you first buy a home, your mortgage payments consist mostly of interest. You’re paying very little toward the principal. You do have the option of making extra payments toward the principal, but you should not look at your home as if it were an investment.

Here’s just one example of why your home may not be an investment. Back in 2008, the housing market crashed. The crash had multiple causes, but one of the most significant was the rise of the subprime mortgage and other predatory lending practices. Fluctuations in the housing market and in interest rates can erode or even eliminate your equity.

The bottom line? It’s not a good idea to look at your home as an investment. If you want to buy, you can certainly do so – but you should make other investments to plan for your retirement.

Your Home is Your Biggest Asset

Our next mortgage myth is related to the last one. Is your home your biggest asset? We asked Krista Goodrich, aka The Boss Lady Investor. She says:

“Most of us have heard this old saying at some point in our life and we often believe it because it is the largest and typically most expensive thing we own. Assets are items that are owned by a person (or entity) that bring value. Most people don't outright own their own home, in fact, the bank owns the home until it is completely paid off. Moreover, assets tend to pay dividends. While a home provides shelter, unless you are using the equity to purchase more assets, your mortgage charges you interest rather than paying you interest.”

Krista goes on to say that she cautions the people she advises to think of their home as a debt until it’s paid off – or at least paid down to the point that a recession or housing crash won’t leave them upside-down on their mortgage.

We’d like to add the fact that your home is a liability, at least at first, shouldn’t stop you from buying a home if you want to buy one. Rather, we’d say that you should be aware of the realities of homeownership, shop for a competitive mortgage rate and make extra payments toward the principal of your mortgage if you can afford to do so. This will allow you to build equity as quickly as possible.

Shopping for the Best Interest Rate Will Hurt Your Credit Score

This next myth is one that we often encounter when we talk to our members about mortgages. There’s a common misperception that shopping around for a mortgage will do significant damage to your credit score.

While it is true that hard credit inquiries will knock a few points off your score, there is a protection in place to allow homebuyers to shop for the best rates. FICO considers all inquiries that occur within 30 days of one another to be one inquiry.

In other words, your credit score will take a small hit when you shop for a mortgage, but provided you make all inquiries within the same 30-day period, the impact will be minimal. And, considering that even a difference of a fraction of a point on your interest rate could save you thousands of dollars over the term of your mortgage, it’s always a good idea to shop before you commit to a mortgage rate.

Your Down Payment is Your Only Up-Front Cost

Our final mortgage myth is one that trips up many first-time homebuyers. We’re surprised at how many people believe that if they’ve saved for a down payment, they won’t have any other significant up-front costs when they buy a home.

The truth is that there are many costs associated with buying a home, including:

- The down payment

- Your monthly mortgage payments

- The mortgage application fee

- The home inspection fee

- Closing costs (including the document preparation fee, survey fee, property appraisal and wire transfer fees)

- Mortgage insurance

- Homeowners insurance and flood insurance

- Property taxes

Some of these expenses are up-front while others, such as the mortgage payments, insurance premiums and property tax, are ongoing. It’s important to understand the full cost associated with buying a home before you apply for a mortgage.

We also want to mention a related myth, which is that you must put 20% of the home’s cost as a down payment. The truth is that 20% is ideal but not necessary. There are many down payment assistance programs available and if you qualify for an FHA mortgage, you may need only 3.5% of the home’s cost as a down payment.

Buying a home is a big decision and we want you to go into the process armed with as much knowledge as possible. A big part of that is letting go of your beliefs in common home buying and mortgage myths – and the information we’ve included here will help you do that.

Are you in the market for a new home? Click here to learn about Addition Financial’s affordable mortgages!