Regardless of your age and financial circumstances, you probably have long-term financial goals. Perhaps you want to retire early, fully fund your kids’ college educations or own your dream home.

Whatever your goals are, we want you to meet them. Many of our Addition Financial members ask us for help. They want to know how to set financial goals.

And we’re happy to help! Financial goal setting is a skill that you can learn, and successful goal setting is at the heart of success in any arena. We’ve put together this guide to financial goal setting success to help you.

The Basics of Financial Goal Setting

The first step to effective financial goal setting is understanding how to set realistic and achievable goals. We want to note that “realistic” doesn’t mean you can’t aim high. In fact, the opposite is true. We think you should have big financial goals. The key is to negotiate the difference between “big” and “impossible.”

For example, a big goal would be to save a million dollars. There’s no question that’s a lot of money, but it’s an achievable number for many people, particularly if they’re willing to work hard and make saving a priority.

An unrealistic goal would be to save a billion dollars. Only a few people on the planet have that much money. That doesn’t mean you can’t achieve it, but it’s such a long shot that it’s not a goal we would recommend.

The most commonly-cited acronym to help people remember how to set goals is SMART. The acronym was created by George T. Doran in the November 1981 issue of Management Review. SMART goals are:

- Specific

- Measurable

- Attainable

- Realistic

- Time-bound

To help you understand what that means, here’s are two examples, one of a goal that isn’t SMART and one that is.

- Be a billionaire. (Not a SMART goal because it’s not specific enough, nor is it realistic for most people. It’s also not time-bound.)

- Save $250,000 by the time I’m 50 by living on 70% of my income and saving the rest. This goal is SMART because it meets all five criteria. It’s:

- Specific – The goal includes both a dollar amount and method.

- Measurable – The goal includes an amount, a date, and a specific method.

- Attainable – While $250,000 is a lot of money, this is a goal that’s reasonable for someone who earns a decent income and is committed to saving money.

- Realistic – This might not be a realistic goal for someone who’s working a minimum wage job, but for the sake of this example we’ll assume that the person setting the goal earns enough money to make it realistic.

- Time-bound – The goal contains a built-in timeline that ends when the person making the goal reaches their 50th birthday.

The reason that SMART goals are the ones we recommend is that their specificity and built-in parameters make them achievable. You can plan for a SMART goal while it can be difficult to plan for a goal that lacks the qualities we’ve outlined.

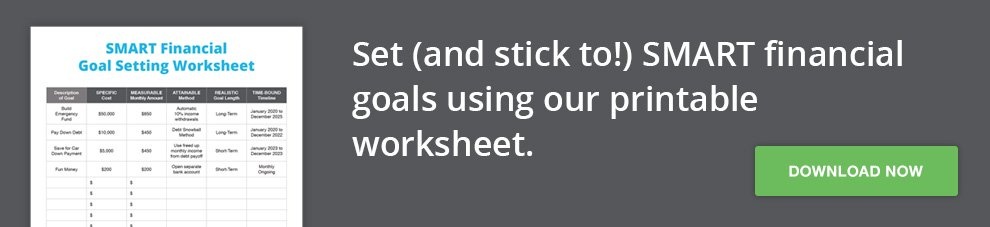

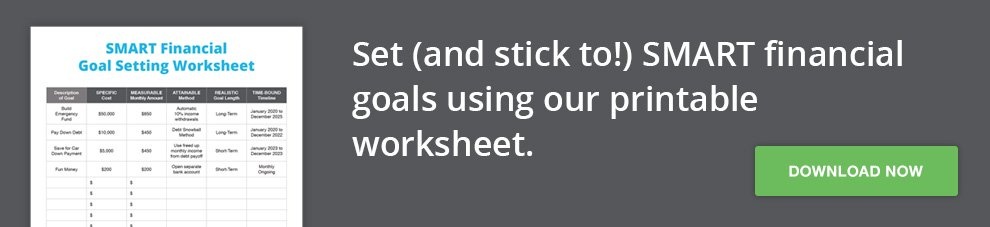

Print Now: The SMART Financial Goal Setting Worksheet

How to Choose Long Term Financial Goals

If you already have a SMART goal, then you can skip this section. However, in our experience, most people start out with long term financial goals that lack some of the details that make a goal achievable.

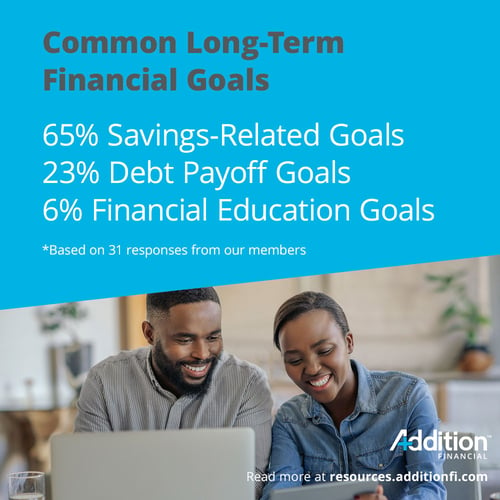

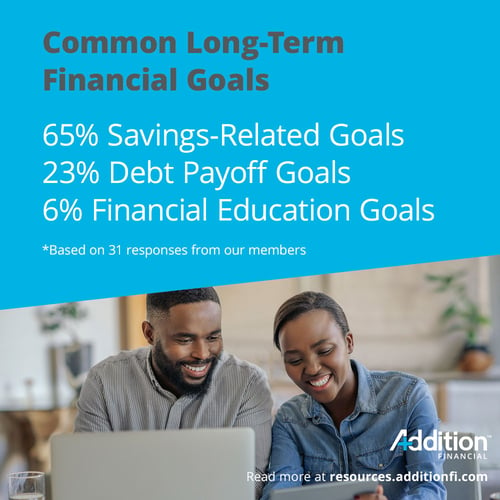

Here are some pointers to help you choose long-term goals. When we asked our Addition Financial members what their financial resolutions were for 2020, we found that most answers fell into three general categories:

Let’s use getting out of debt as an example. You can easily see that “get out of debt” is not a SMART goal because it lacks specificity and a timeline. We’ll give this goal some details to see how we can turn it into a SMART goal.

To make it specific, you’d need to:

- Specify how quickly you want to pay off your debt – For example, you might say that you want to be debt-free before December 31, 2021.

- Specify a percentage of your monthly budget you can use to pay down your debt – For example, maybe you can afford to set aside 10% of your net income for debt reduction.

- Choose a debt reduction method – For example, you might elect to use the avalanche method, which would mean that you’d pay the minimum for every credit card except the one that has the highest interest rate and put extra toward that balance until it’s paid off, and so on.

Your completed goal might read:

Set aside 10% of my monthly income to pay down credit card debt using the avalanche method and be debt free by the end of the 2021.

That qualifies as a SMART goal because it ticks all the boxes:

- It’s specific because you’ve clearly identified your goal.

- It’s measurable because you can measure your monthly payments and other factors, such as the time frame.

- It’s realistic because you’ve crunched the numbers and you know you can achieve your goal.

- It’s attainable because you’ve come up with a method that will allow you to attain it.

- It’s time-bound because you have set a deadline along with monthly goals to help you achieve it.

When you set a goal, you should ask yourself if it meets the criteria of the SMART method to be sure you’ve covered your bases and can reach your goal.

Tips for Breaking Down Goals into Manageable Steps

One of the most important things to do with long-term financial goals is to break them down into manageable steps. For this section, we want to choose a goal that will take several years to achieve: early retirement.

Here’s an example of a SMART goal for early retirement:

I want to retire by my 55th birthday by saving and investing 30% of my net income each month.

We’ll need to add some more specifics to make this goal truly SMART because it doesn’t specify how the money will be invested. Let’s look at how you could break down each part of this goal, starting with the mini-goal of investing 30% of your net income.

1. Create a household budget that enables you to live on just 70% of your net income. This step needs to come first because your goal is not achievable without it.

2. Create automatic transfers to move the 30% you’ll be investing and saving into various accounts, including high-interest savings accounts, money market accounts and retirement accounts.

3. Decide how you will invest the 30% that you want to invest. For example, you might:

- Max out your 401k contribution at work and take advantage of employer matching if it’s available.

- Open a traditional or Roth IRA, maximize your contributions for each year and choose investments in accordance with your goals.

- Meet with a financial planner to work out an investment strategy for you and your family.

- Use a robo-advisor to help you choose stocks to buy.

4. Create a schedule to review and adjust your investments regularly.

5. Roll any “found” money, such as raises and holiday bonuses, into your retirement savings.

Each one of these mini-goals is designed to help you reach the big, long-term goal of early retirement. To break down your goals, you should start with your big goal and think about what you’ll need to do to achieve it.

For example, imagine you have the goal of saving enough money to pay for your child’s college education in full, so they don’t need to take out any student loans. Your list of interim steps might include:

- A debt reduction strategy

- Household budgeting

- A savings strategy

- An investment strategy

Each one of your strategies should be broken down into achievable goals as well, like this:

- Debt reduction. Use the avalanche method to pay all credit card debt within three years.

- Household budgeting. Create a household budget that allows you to live on 70% of your net income, leaving you with 30% for debt reduction, savings and investments.

- Savings. Set aside money each month and transfer it into a 529 college savings account or another education account, where it can grow and pay for your child’s education.

- Investment. Choose a robo-advisor and make investments in the stock market to grow your savings.

You can further break down each goal as needed to make sure you are managing your money properly.

One final note: goals can shift and change over time. It’s important to take time to re-evaluate your goals regularly and make sure they are still SMART. You can and should adjust your goals as needed. Unforeseen circumstances can have a big impact on your financial health and outlook and it’s your job to take any changes that occur into consideration.

Setting long term financial goals is an important part of your overall financial well-being. The steps we’ve outlined here will help you to set and stick to your financial goals, so that your future will be what you want it to be.

Need help setting financial goals? Click here to learn how Addition Financial can help!