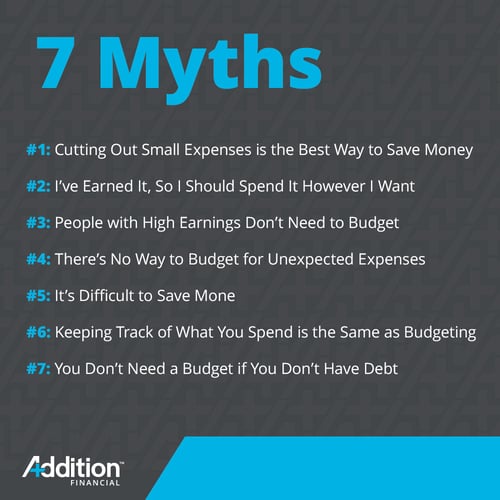

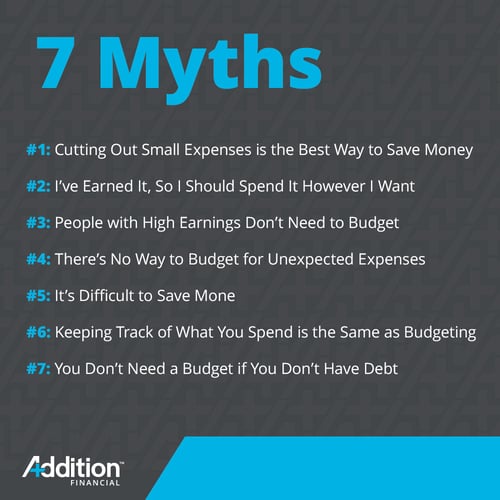

Budgeting is one of the best financial tools we know, but it has negative associations that sometimes prevent people from taking advantage of responsible budgeting. One reason? Some persistent budgeting myths that we hear all the time from our members.

At Addition Financial, we provide budgeting tools and advice because we understand that effective budgeting is the key to paying down debt, saving for a home and planning for retirement. Recently, we asked our members and some financial experts which budgeting myths they had heard and how they combat these persistent rumors.

Here are some of the most common budgeting myths and expert money saving advice to make the most of your money.

Myth #1: Cutting Out Small Expenses is the Best Way to Save Money

Our first budgeting myth is one we heard from several members. It’s known as the Latte Factor, and it says that cutting out small daily expenses – such as a cup of coffee or latte – is the best way to save money.

This is a money myth that has been around for decades and somehow still has a hold on people. We’ll start by saying that it’s not a bad idea to cut back on unnecessary expenses if you’re trying to save money, especially if you’re spending $5 every work day on coffee and $10 on lunch. That kind of spending adds up quickly and you could actually save a decent amount by bringing coffee and lunch from home.

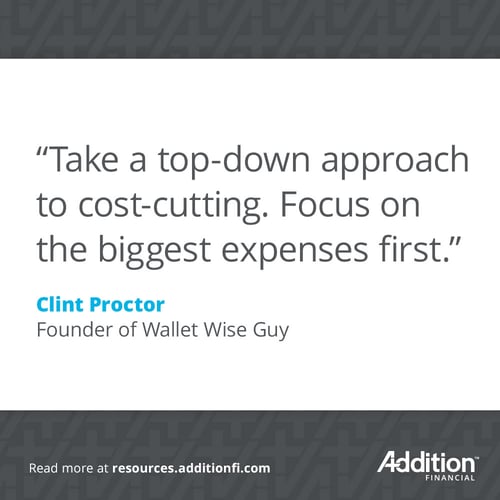

However, here’s what financial expert Clint Proctor, founder of Wallet Wise Guy, has to say about the Latte Factor:

“… It’s a great idea to shop around for everything we buy, [but] certain expenses can only provide marginal gains. On the other hand, paying close attention to your home and transportation costs can make a dramatic difference in your budget.

For instance, buying a house that's $50,000 less expensive could easily save you $300 or more each month. Do you spend $300 each month on lattes?

The point? Take a top-down approach to cost-cutting. Focus on the biggest expenses first. Striving to get your housing and transportation costs below 50% of your monthly take-home pay would be a great start.”

The top-down approach is the best option for saving significant amounts for long-term goals such as retirement. On the other hand, if you want to save for a short-term goal such as a family vacation, cutting out small expenses is a good way to do it.

Myth #2: I’ve Earned It, So I Should Spend It However I Want

Our next myth is one that is often used to justify overspending on unnecessary or frivolous items. When you work hard to earn a living, it may be tempting to spend what you earn without giving much thought to the consequences.

It’s not untrue that your money is yours to spend, but the problem with this myth is that it stands in direct opposition to important long-term financial goals. If you spend everything you make, you’ll be living paycheck to paycheck. You may also be left without the money to deal with emergencies.

Our advice is to stick to a budget that allows you to enjoy your life while also putting something away for the future. Sticking to a budget doesn’t mean you need to live an austere life. We like to think of budgeting as a tool that allows you to live within your means.

Myth #3: People with High Earnings Don’t Need to Budget

When people earn a high income, it’s common for budgeting to go out the window. There’s a common misperception that wealthy people – or even people who are comfortable – don’t need to worry about where their money is going.

This is a dangerous myth because it can easily lead to overspending. Jacob Dayan, co-founder and CEO of Community Tax, has this to say about budgeting:

“If you think making a budget or savings plan is only for people who are struggling financially, you need to think again! Whether you have $50 in your bank account or if you're a millionaire, you need to allocate your money responsibly. Establishing a budgeting plan makes your spending habits clear and gives you more control and organization over your cash flow. It also helps you produce extra money by providing more investment opportunities and identifying unnecessary expenses.”

We agree completely with this advice. There’s a tendency to hear the word “budget” and think about living with the bare necessities. That’s not necessarily the case. A budget is a framework for spending and saving, and spending may be high or low depending upon your income and needs.

Your budget should start with necessary expenses and work from there. You’ll need to allocate money for housing, transportation and other necessities first. Once you’ve done that, you can budget for entertainment and the other things that make life enjoyable. Start here with our monthly budget expenses calculator.

Myth #4: There’s No Way to Budget for Unexpected Expenses

One of the most common objections to budgeting is that it doesn’t matter because there’s no way to budget for your car breaking down or other unexpected expenses.

We agree that it’s impossible to predict everything, but we strongly disagree that your budget can’t help you be prepared to deal with the unexpected.

You have two options to stay prepared for unexpected expenses:

- Set aside money in your monthly budget for an emergency fund. A good guide is to have six months’ worth of expenses set aside. Once the fund is in place, do not touch it unless it’s an emergency. And, if your monthly expenses increase, add enough money to your fund to ensure you have what you need.

- Add a line item for Miscellaneous Expenses to your budget. For example, a $200 line item might cover a minor repair to your car or an unexpected trip to the vet. If you don’t spend it, you can transfer it into a savings or retirement account at the end of the month.

When and if you dip into your emergency fund, make it a priority to add to it until it’s back to where it needs to be.

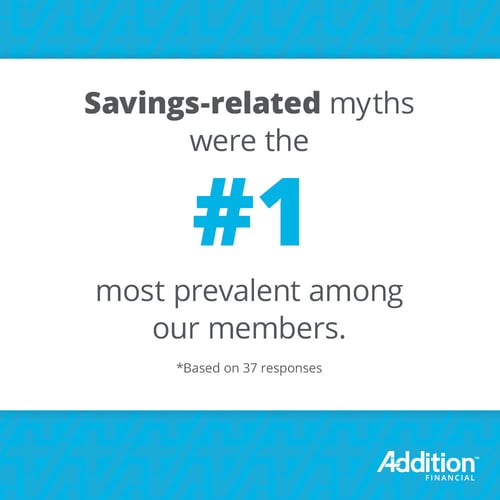

Myth #5: It’s Difficult to Save Money

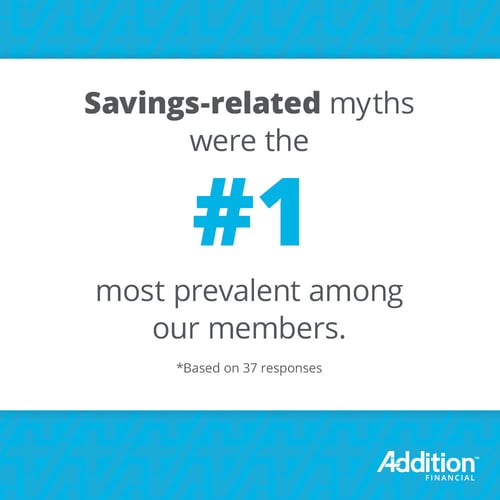

One budgeting myth that our members mentioned is the myth that saving money is difficult. While we’d agree that some people struggle with saving money and budgeting, we think that’s often the result of misinformation and not a question of objective difficulty.

The key as we see it is to make a commitment to saving money and find the tools you need to help you do it. That might include a budget calculator or a financial app that you can link to your bank account.

We also suggest taking the time to articulate your savings goals. If you have the general goal of saving money, you might lose sight of it. However, with a specific goal, you can determine how much you need to save each month and plan accordingly. Addition Financial’s vacation and holiday savings accounts can help you save for short-term goals.

Test Yourself Now: The Money Myths Buster Quiz

Myth #6: Keeping Track of What You Spend is the Same as Budgeting

We’ve heard from some Addition Financial members that they believe tracking their spending is just as effective as budgeting. This myth is one that’s potentially dangerous because it can lead to out-of-control spending.

The issue with tracking spending is that it looks only at past behavior. It doesn’t set limits on what you spend or ensure that you have the money you need for necessary expenses.

We still think it can be beneficial to track spending. Some people find it useful to write down what they spend in an app or notebook. It serves as a deterrent to overspending. However, responsible saving and spending starts with a budget.

Myth #7: You Don’t Need a Budget if You Don’t Have Debt

The final budgeting myth we want to debunk is one that says that people who aren’t carrying debt don’t need to worry about creating a budget.

While it’s certainly admirable to be debt-free, achieving that goal doesn’t mean you don’t need a budget. In fact, there are many good reasons to have one. For example:

- Having a budget will help you stick to your spending limits.

- A budget allows you to work toward short-term and long-term savings goals.

- Being debt-free now doesn’t mean you’ll always be without debt. It’s always a good idea to have a nest egg.

- Budgeting can reduce money-related stress and give you the freedom to enjoy your life.

While budgeting and debt reduction are undeniably related, being debt-free shouldn’t be an excuse to avoid budgeting – especially when it can help you with savings and investment goals.

Creating a monthly household budget may seem like a daunting task, particularly if you have never done it before. That’s why we’ve taken the time to debunk common budgeting myths and provide you with expert savings advice. We want our members to achieve their financial goals!

Need a savings plan to help you plan your monthly budget? Click here to check out our flexible savings accounts and choose the one that’s best for your needs.