High schoolers study a variety of subjects, including everything from computer science to ancient history. But there’s one thing they should learn that they usually don’t: personal finance basics.

At Addition Financial, we know the value of learning about personal finance at a young age. Students who understand the basics are more likely to avoid unnecessary debt and actually save enough for a comfortable retirement.

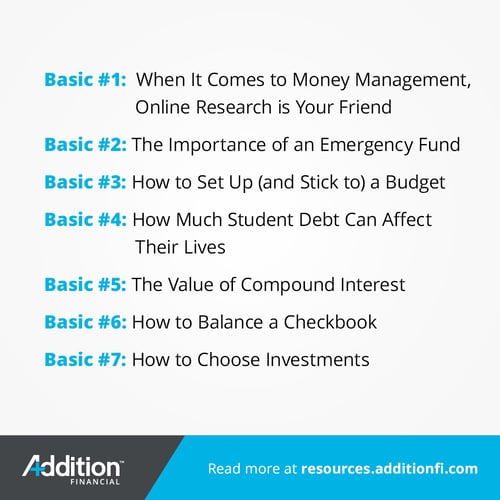

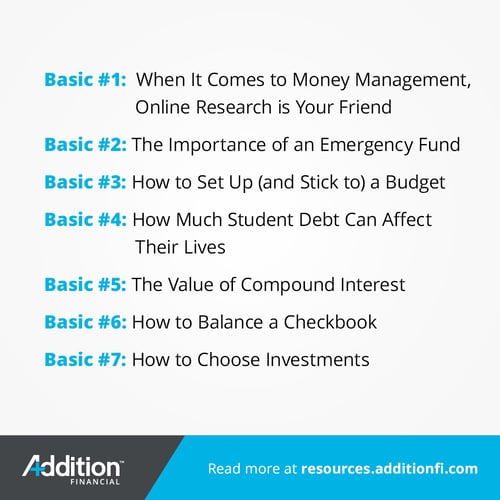

We recently asked some financial experts what personal finance basics all high schoolers should learn. Here are seven personal finance basics to help you increase your chances of financial success as a high schooler.

#1: When It Comes to Money Management, Online Research is Your Friend

This first tip is one we imagine will be easy for young people to embrace. It comes to us from Logan Abbott, who runs Wirefly.com. He says:

“You can always find a better price for a product or service by doing a few minutes of research online. Gone are the days where you buy something just because of some good marketing or sales pitch.”

He goes on to point out that online research can help you in nearly any area where you spend money, including:

- Interest rates/credit cards

- Cell phone plans

- Renting an apartment

- Health insurance

- Car insurance

We would add checking and savings accounts to the list, as well as investment accounts. There’s no reason not to spend a few minutes researching anything related to your finances. That means understand what you’re buying, reading reviews and comparing your options before buying. It can also mean partnering with a financial institution like Addition Financial. We provide a full array of online resources for our members.

#2: The Importance of an Emergency Fund

The second personal finance basic has to do with putting money into an emergency fund, and it’s something we heard about from several of our financial experts. When you’re a teenager, it’s easy to rely on your parents for emergencies – but you won’t always be able to do that.

Molly Ford-Coates, an Accredited Financial Counselor and the founder and CEO of Ford Financial Management, says this about saving for emergencies when you’re young:

“As a teenager, if you learn about the basics of [saving for emergencies], you will have a higher probability of having a secure future. Starting to save early and building that emergency fund can help tremendously if there is a $1,000 emergency. Being able to take it from your savings account is far more beneficial than putting it on a credit card or taking out a loan.”

We also heard about emergency funds from Cyrus Vanover, founder of The Frugal Budgeter. He said:

“Things happen. And when they do, it's important to have some money in the bank to carry you through until things get better… Because of this, you can never start saving too early in life.”

Our recommendation is to save a little bit of money every month for your emergency fund. Save that money first, before you buy anything else. A good rule of thumb is to have six months’ worth of savings in your emergency fund. That means sixth months worth of anything that you pay for out of pocket: rent, food, gas for your car, clothing and even entertainment expenses should be covered by your emergency fund.

#3: How to Set Up (and Stick to) a Budget

Budgeting your money is a personal finance basic that every adult needs to know. The earlier you learn how to do it, the better off you’ll be.

Brian Davis of SparkRental has this to say about budgeting:

“High schoolers should first and foremost understand how to both create and live within a budget. Those are actually two very different skill sets: one is theoretical, and the other is behavioral.”

It’s important to understand the difference between creating and sticking to a budget. When you create a budget, you’re setting limits for yourself. A budget can’t be carved in stone because it’s not always possible to predict what you’ll spend. But the behavioral part of it is the key because your budget won’t be worth anything if you don’t stick to it.

You may want to consider using a budgeting app such as Mint, which is free and can be linked directly to your bank account.

#4: How Much Student Debt Can Affect Your Life

Unless you’ve been living under a rock, you know that student loan debt can be crippling and impact your life for decades after you graduate from college. It should come as no surprise that learning how to reduce student debt is a personal finance basic our experts mentioned.

Vanover also mentioned this issue. He says:

“Many people believe that going to an expensive school is the ticket to landing a lucrative career. Many hiring managers, however, don't care all that much about the name on your diploma. They are far more interested in your talents and abilities. Because of this, it's vitally important to attend the most affordable school you can so you don't graduate deep in debt.”

Clint Proctor of Wallet Wise Guy says something similar:

“One of the most important financial principles for high schoolers to understand is that the college you choose will have a dramatic impact on the price you pay. By simply choosing a public in-state college instead of an out-of-state or private university, students could literally save tens of thousands of dollars in college tuition.”

We would add that you can get a good education anywhere. You don’t need to saddle yourself with tens of thousands of dollars of debt to get the education you need. You may even want to consider attending a community college for two years before going to a university.

#5: The Value of Compound Interest

A lot of high schoolers want to "get rich," but not many high schoolers understand the basics of building wealth. One simple part is compound interest.

The saying "money makes money" is true. When you put money in a savings account you earn interest; where the bank pays you a certain percent of the money in the account. Some savings accounts earn more than others, and there's different types of interest. We're talking about compound interest.

Ilene Davis is the author of Wealthy by Choice: Choosing Your Way to a Wealthier Future, says this about compound interest:

“[High schoolers should learn the] rule of 72 to understand how compound interest works for both debt and wealth – particularly how inflation can increase the cost of living, or the value of investments.”

The rule of 72 says that you can divide 72 by the annual rate of return on an investment to figure out how many years it will take for the investment to double. A $1,000 savings with a 7% annual rate of return would double to $2,000 in a little over 10 years (72/7 = 10.288)

Vanover mentioned this issue too, saying:

“Compounding interest is an amazing thing. If you start investing in a retirement account when you are young, there's no reason why you can't retire as a millionaire. Many people don't get started saving for retirement until it's too late. By the time they realize they need to start saving, they are often too old to realize the benefits of compounding interest. But if you start when you are young, your golden years can truly be made of gold.”

We suggest making saving for retirement a priority when you get your first job. Even setting aside a small amount each month can help you jump-start your retirement savings thanks to compound interest.

#6: How to Balance a Checkbook

A personal finance basic we haven’t mentioned yet is balancing a checkbook or account statement. If you don’t balance your accounts each month, there’s a risk that you’ll:

- Miss errors made by the bank

- Miss mistakes that you made entering transactions in your checkbook

- Overlook potential fraud and/or identity theft

This was another issue mentioned by Vanover, who added:

“[Balancing a checkbook is] a critical skill that helps to identify when something is amiss.”

If you’re not sure how to balance your checkbook, don’t be afraid to ask for help. At Addition Financial, we’re happy to work with our members to ensure they have the basic financial skills they need.

#7: How to Start Investing

Investing might seem like something only rich people do. But anyone can invest—and our financial experts agree.

Davis says:

“High school graduates should have a basic grasp of how to invest in stocks and ETFs. They don't need to know how to pick stocks, but they should invest in a handful of index funds. I recommend automating this with a robo-advisor – again I use Schwab, but there are several other good free ones available on the market.”

An ETF is an exchange-traded fund. They make good investments because they spread out risk over multiple stocks. Invesco QQQ is an example of an ETF. It tracks the NASDAQ 100.

Buying stocks is easier than ever thanks to robo-advisors. You don’t need to be an expert or even somebody who follows the stock market. The one thing you will need to do is review your stocks regularly. It’s a good rule of thumb that you shouldn’t have more than 5% of your assets in any one stock.

One of the best things you can do for yourself (or for your high school-age kids) is to learn about personal finance basics. The education you receive at a young age will serve you throughout your life, ensuring that you have a financially stable future.

Need to open an account to get on track with your personal finances? Click here to learn about Addition Financial’s student checking accounts!