We all hope to retire one day. You may even be someone who dreams of an early retirement. That’s an admirable goal – but are you putting it out of reach by clinging to common retirement and investment myths?

At Addition Financial, we’re committed to helping our members make the best financial decisions. The only way to do that is to educate them about financial realities.

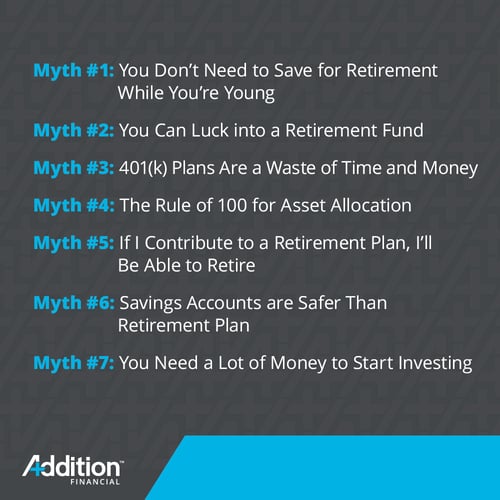

We recently asked our members and some financial experts about the retirement and retirement and investment myths that cost people the most money. Here are seven of the costliest (and most persistent) myths they mentioned.

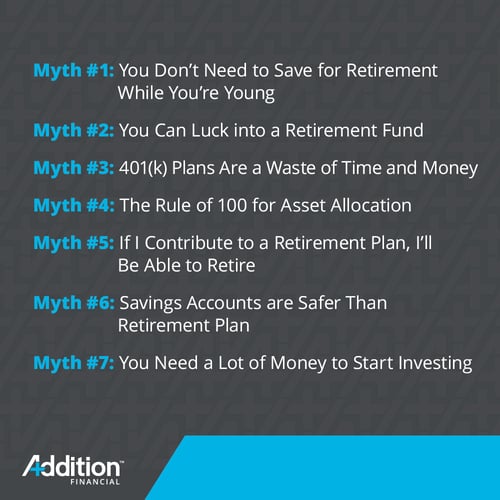

#1: You Don’t Need to Save for Retirement While You’re Young

Our first myth is a very common one – and if you believe it, it could mean that you wind up without enough money to retire comfortably. A lot of people believe when they’re in their 20s and 30s they don’t need to worry about saving for retirement.

This retirement myth is dangerous. The truth is that it takes a lot of time to save for retirement. The earlier you start, the more likely it is that you’ll have a sum that will allow you to retire without worrying about money.

Whether you contribute toward an employer-sponsored 401(k) account or open a personal IRA, you should begin saving immediately. The money you invest now will have plenty of time to grow, and you’ll also have time to ride out any fluctuations in the stock market. Over time, you can reallocate your assets as needed – something we’ll talk about later in this post.

#2: You Can Luck into a Retirement Fund

Quite a few of our members mentioned retirement myths that are rooted in common sayings about money. They might seem funny, but there’s a kernel of truth in them because many people do rely on luck when it comes to saving for retirement. Here are a few examples of what we mean:

- Successful retirement planning can be achieved through buying lotto scratch-off tickets.

- There’s a pot of gold at the end of the rainbow.

- Pick a career you love and money will come.

Silly, right? But there are people who truly count on winning the lottery or magically saving enough for retirement. The truth is that retirement requires planning. If you don’t have a concrete plan for retirement, you may find that you don’t have enough to stop working when the time comes.

The best retirement plan is one that’s consistent. We suggest committing to saving a percentage of your take-home pay. If your employer offers a retirement plan, contribute the maximum amount allowed and make sure to take advantage of employer matching contributions. And finally, put windfall money (holiday bonuses and inheritances are two examples) into investments.

#3: 401(k) Plans Are a Waste of Time and Money

401(k) plans are easily the most popular kind of retirement savings plan. According to CNBC, half of all Americans have access to an employer-sponsored plan.

Many people do contribute to 401(k) plans but some don’t. One myth that we heard from our members is that some of them were told contributing to a 401(k) was a waste of time and money. A related myth says that a stock market crash would lead to a total obliteration of 401(k) savings.

As with most money myths, there’s a tiny kernel of truth hidden in this myth. There is risk associated with any investment plan. If you have a 401(k) plan and put a significant percentage of your contributions into the stock market, there is a chance that you will lose money in a market decline or crash.

However, it’s important to remember that stock investments always ebb and flow. That’s inevitable and it’s something we all need to accept if we want our money to grow. Even more importantly, stock market trends over time trend upward. If you can keep your head and leave your investments alone, the odds are in your favor.

If you prefer, you can mitigate your risk by managing your asset allocation and putting more money into exchange-traded funds, which spread your risk over multiple stocks.

Test Yourself Now: The Money Myths Buster Quiz

#4: The Rule of 100 for Asset Allocation

Our next investment myth comes from Brian Davis of Spark Rental. He brought up the well-known “Rule of 100” for asset allocation, which says that an investor should subtract their age from 100 to determine what percentage of their assets to put into the stock market. He says:

“Today, that rule leaves most Americans underexposed to stocks, over-invested in bonds and with no exposure to investment real estate. Americans should instead subtract their age from 110 or 120 to determine their stock allocation, and consider diversifying into real estate as well through REITs (public or private) or some other form of direct or indirect investment.”

We can’t tell you what your tolerance for risk is, but we think Brian’s rule is a good one. If you’re 35 years old, you can probably afford to put 75% to 85% of your assets into stock. That gives you the best possible chance to grow your investment.

Keep in mind that you should reevaluate your asset allocation regularly. You can find our guide to asset allocation best practices here.

#5: If I Contribute to a Retirement Plan, I’ll Be Able to Retire

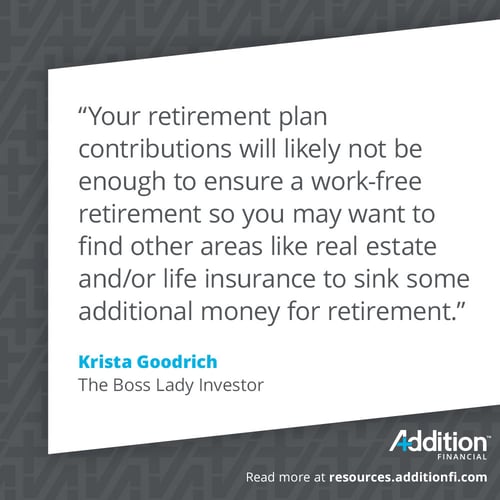

Another myth we heard from a financial expert may lead people to contribute less to their retirement plans than they should. It comes from Krista Goodrich of Boss Lady Investor.

We know some people think the fact that they’re contributing to a retirement plan ensures they’ll be able to retire. Here’s what Krista says about this retirement myth:

“… your retirement plan contributions will likely not be enough to ensure a work-free retirement so you may want to find other areas like real estate and/or life insurance to sink some additional money for retirement. For example, if you start contributing to your IRA at age 30 and max it out each year until age 60, you will have contributed $150,000 towards retirement. Assuming a 7.2% rate of return, you would have over $525,000 at age 60 – not bad! But if you live another thirty years, that means you have approximately $17,500 per year to live on (not including social security). Plus, inflation strikes again so your $17,500 in today's dollars will equate to even less than it is today.”

We agree with Krista. Contributing to a 401(k) or IRA is a good start and will put you in better shape than many people. However, your best bet is to implement an aggressive retirement savings plan. Start early, take risks, and reallocate your assets regularly to ensure that you’re not concentrating your investments in any one stock.

#6: Savings Accounts are Safer Than Retirement Plan

Our next retirement myth also comes from Krista, and it’s a myth we’re very familiar with. It’s a common misconception that it’s safer to put money in a savings account than in a retirement account.

The truth about this myth depends on your definition of the word “safe.” Here’s what Krista has to say about it:

“If your goal is to have a set amount of money today (let's say $10k for our example) and it still be there in twenty years, then yes, a savings account may be the way to go. The problem is, in 20 years, you will theoretically have less money because $10k today will purchase way more than $10k will in twenty years. Because of inflation, you would likely actually be guaranteed to lose purchasing power with a safer investment like a savings account.

Stocks, bonds, mutual funds, index funds, and even real estate are riskier and more volatile for short-term returns, but over long periods of time tend to produce returns that keep up or outpace inflation – which in my opinion makes them less risky investments for buy and hold strategies (such as retirement).”

Savings accounts are ideal for short-term goals, such as buying a new car or taking a dream vacation. They’re not ideal to save money for long-term goals because your money won’t be working for you and growing.

#7: You Need a Lot of Money to Start Investing

Our final myth is one that we hear time and again from our Addition Financial members. There’s a persistent belief that only rich people can buy stock.

If there’s one investment myth we could debunk for good, we’d pick this one. Why? Because it stops people from investing their money and ultimately, may prevent them from retiring in comfort.

The truth is that anybody can invest their money. You don’t need to be wealthy and even investing a tiny percentage of your income is better than investing nothing. With the rise of robo-investors and online stock brokers, there’s no reason that you can’t take your money and use it to start planning for retirement.

We suggest starting with a set percentage of your take-home pay. Even putting 3% of what you make into investments will be enough to get the ball rolling. As your income grows, you can contribute a higher percentage.

Investment money and saving for retirement are two of the best things you can do to secure your financial future. The seven retirement myths we’ve debunked here might have been getting in your way – but we hope you are now armed with the information you need to plan for a comfortable and enjoyable retirement.

Do you need assistance setting up a retirement account? Click here to learn how Addition Financial can help!