Do you have short-term financial goals? We think it’s always a good idea to have your sights on something you want to achieve financially. It’s one of the best ways we know of to manage your money effectively and ensure your future.

At Addition Financial, we get a lot of questions about financial planning. One of the things we get asked a lot is this:

“What are some good short-term financial goals to set for myself?”

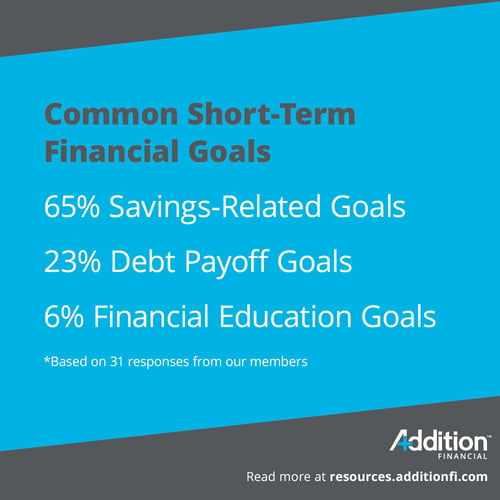

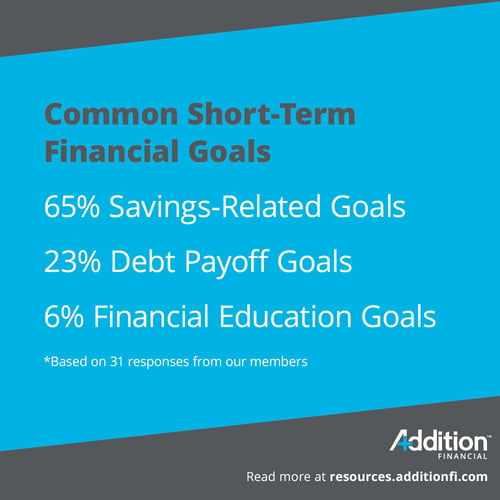

We love that question. We recently asked our Addition Financial members to share some of their financial goals. Some of the things we heard represented long-term goals, but many qualified as short-term goals, too.

With that in mind, here are seven short-term financial goals with examples to inspire you in 2024.

Goal #1: Save for a Down Payment on a Home

Our first short-term goal is to save for a down payment for a home. This is one several of our members mentioned. There are a lot of benefits to homeownership, but you can’t get to that point without a down payment.

A good rule of thumb is that you should plan to put 20% of the purchase price of your home as a down payment. This strategy will help you get a better interest rate on your mortgage. Here are some examples of how you can meet the short-term goal of saving for a down payment:

- Pay down your high-interest debt

- Trim your budget for discretionary spending

- Consolidate your insurance policies with one carrier to get a bundling discount

- Set up an automatic transfer to a high-yield savings account

- Set aside “found money” such as raises, bonuses and other windfalls

Addition Financial offers an Insured Money Market Account that’s ideal for first-time homebuyers who want to save for a down payment.

Goal #2: Save for a Family Vacation

Maybe 2021 is the year you want to take a once-in-a-lifetime family vacation. A lot of our members mentioned wanting to save for specific events, including vacations, destination weddings, and new vehicles. Here are some pointers to help you reach your family vacation savings goal:

- Review your budget and find areas where you can reduce your spending.

- Gamify your savings to get the kids involved by setting mini-savings goals and awarding prizes for the person who saves the most.

- Open a Holiday and Summer Savings account with Addition Financial. This is our goal-oriented savings account and a great tool for people who are saving with a specific goal in mind.

Short-term saving gives you and your family a shared goal with a reward for your efforts. That makes it a worthwhile goal as far as we’re concerned!

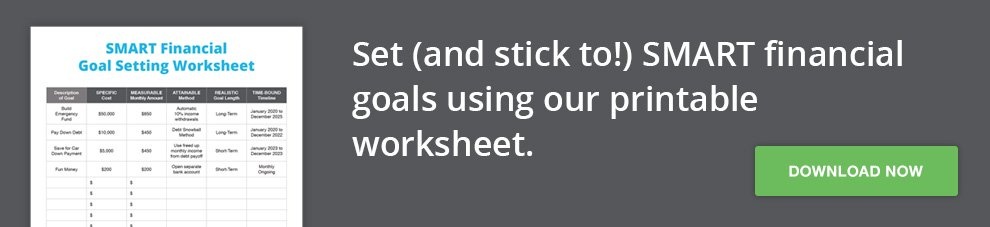

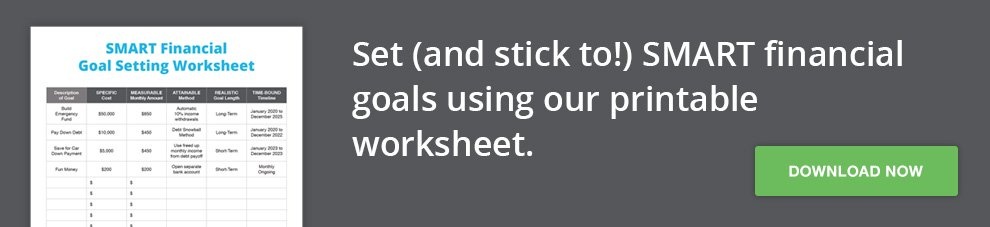

Print Now: The SMART Financial Goal Setting Worksheet

Goal #3: Start Investing

Investing your money is a good idea if you want to save for retirement, but it’s also a topic that can be intimidating to some people. As a short-term goal, it makes sense to focus your attention on the first steps you need to take to get started. Here are some pointers:

- Create or review your monthly household budget to decide how much you can afford to invest.

- Evaluate your risk tolerance. Some people are comfortable with the uncertainty of the stock market while others prefer more predictable investments. Usually young people can afford to take more risks with asset allocation than older people who are close to retirement.

- Choose an investment tool to get started. You might opt-in to your employer-sponsored 401(k) plan, open an IRA or use a robo-advisor to help you choose stocks.

Once you’ve achieved the short-term goal of investing, you can create new short- and long-term goals to keep the ball rolling.

Goal #4: Pay Down Debt

One of the most common New Year’s resolutions we hear from our Addition Financial members is the goal of paying down debt, including both high-interest credit card debt and mortgage debt. If getting debt-free is one of your goals, here are some tips to help you do it:

- Start by getting a handle on your debt. List your credit cards with pertinent information, including your balance, interest rate and minimum payment.

- Choose a credit card repayment strategy such as the avalanche method, which involves paying extra toward the card with the highest interest rate until it’s paid off and then rolling the extra payment into the card with the next-highest rate.

- If you want to make payments toward the principal of your mortgage, check your lender’s rules regarding principal payments and build the extra payment into your budget. One easy way to pay a little extra each year is to make bi-weekly payments instead of monthly payments. It won’t have much impact on your budget, but you’ll make one full extra payment every year.

Debt reduction can save you thousands of dollars over time, making it an excellent short-term financial goal for 2024.

Goal #5: Create and Stick to a Household Budget

Many of our members told us they wanted to get a handle on their budgets in 2024. If you don’t have a household budget yet, the new year is the perfect time to set one up. After all, many of us spend more than we intend to simply because we’re not keeping track.

We suggest you start with our free monthly budget expenses calculator. You can use it to figure out what you spend each month and then adjust it to reflect what you want to spend and save.

Setting up a budget can be a good first step for many of the other short-term financial goals on this list. For example, once you’ve entered your income and expenses, you can create budget line items for:

- Holiday savings

- A down payment on a home

- College savings for your kids

- Debt reduction

You get the idea. A reasonable household budget is a tool we think everybody should have to help them reach their financial goals.

Goal #6: Cut Spending

One of our favorite resolutions came from an Addition Financial member who said she wanted to live as frugally as possible in 2024. Her motto was, “Use it up, wear it out, make it do or do without!”

Frugality might not sound like a good time, but we think it can be fun if you approach it with the right mindset. It’s very common for our members to tell us that they sometimes spend money when they don’t need to. If that sounds familiar, here are some pointers to help you live more frugally:

- Look at goal #5 above and create a household budget that reflects what you want to spend.

- Before you buy something, take a moment to consider whether you need it – and buy it only if the answer is yes.

- Cook meals at home instead of eating out – and bring lunch to work!

- Embrace thrifting and make do with what you find in thrift stores.

- Seek out low-cost entertainment options such as museums – or check out admission passes from your local library.

- Experiment with generic brands at the grocery store – in many cases they taste the same as name brands at much lower prices.

These are just a few examples of cost-cutting measures you can adopt to live more frugally in the new year.

Goal #7: Create an Emergency Fund

Our final short-term resolution is one that we think everyone should adopt. If you don’t already have an emergency fund in place, 2024 is the perfect time to create one.

Your emergency savings fund should have three to six months’ worth of expenses in it. Six months is the best bet. The idea is that the money in your fund will be there if something unexpected happens. For example, if you’re the sole breadwinner for your family and you lose your job, the emergency fund provides peace of mind in uncertain financial times.

Here again, we suggest that you start with a family budget and create a line item for your emergency fund. Decide how much you can save and transfer money automatically each time you get paid. You can incorporate many of the same savings techniques we talked about in goals #1 and #2.

Once your emergency fund is complete, you can roll your savings methods over to save for other things, such as a vacation, a new car or a bigger house.

Keep in mind that your expenses will change over time. Provided you don’t dip into your emergency fund, you should evaluate it every six months or so – or more often if something changes. For example, if you move to a bigger house with a higher mortgage payment, you’ll need to add to your emergency fund to ensure you can cover your new expenses.

The new year is the perfect time to set short-term financial goals. The seven goals we’ve listed here – along with suggestions on how to achieve them – can be your jumping-off point for a financially healthy new year!

Need some help achieving your short-term financial goals? Click here to visit Addition Financial’s online financial education center for resources and guidance.