Choosing the right checking account for your needs requires evaluation of your requirements and research to understand the options available. With many types of checking accounts available, it may be helpful to have some guidance to be sure you select the account that meets your needs.

At Addition Financial, we want every one of our members to get the guidance they need as they compare checking accounts. We’ve created this guide to help you understand the pros and cons of various types of accounts and choose the checking account that’s perfect for you.

What Are the Different Types of Checking Accounts Available?

Before you open a personal checking account, you should have an understanding of the various types of checking accounts that are available. Any credit union or bank you consider will offer multiple options.

Traditional Checking Account

A traditional checking account or standard checking account is the most common type of checking account available and most financial institutions have a checking option that falls into this category.

With a traditional checking account, the account holder gets a supply of checks and a debit card to use at ATMs. There may be fees associated with a standard checking account, but some financial institutions waive them if you maintain a minimum balance. You should also expect to have access to secure online and mobile banking and basic checking account features such as online bill pay and overdraft protection.

Interest-Bearing Checking Account

An interest-bearing checking account comes with all the features of a traditional checking account. What sets them apart is that you’ll have the ability to earn interest or dividends on your deposits, something that is usually associated with savings accounts.

It’s common for there to be a minimum balance requirement to earn a return on your deposit. You’ll get the highest rate of return in the form of dividends if you join a credit union. There may be checking account fees associated with an interest-bearing checking account. Some financial institutions waive the monthly fee if you have a monthly direct deposit into your account.

Rewards Checking Account

A rewards checking account has a lot in common with a rewards credit card. If you have this type of account, you’ll earn incentives—usually in the form of points—when you use your debit card for purchases.

If you opt for a rewards checking account, make sure you understand whether there’s a cap on the amount of points you can earn and whether there are requirements or restrictions that you’ll need to meet in order to earn points.

Student Checking Account

Many credit unions and banks offer a checking account that’s designed specifically for young people who are heading to college and beginning their adult lives. These accounts typically come with checks, a debit card, overdraft protection, and ATM fee waivers.

Any student attending an out-of-state school should look for a student checking account that reimburses foreign ATM fees, since these can add up quickly if you’re out of your financial institution’s service area.

Free Checking Account

Free checking accounts are simple accounts with limited features, but they’re desirable for some because they don’t charge a monthly fee.

Some of the features you should expect to find with a free checking account include online and mobile banking, bill pay, and no minimum balance requirement.

Second-Chance Checking

If you’re someone who’s had difficulty with overdrafts in the past, you may not qualify for a traditional savings account. Many financial institutions offer a second-chance checking account to allow people to improve their financial situation.

Addition Financial’s Opportunity Checking Account offers features that include direct deposit and payroll deductions, a complimentary ATM card and no minimum balance requirement. After 12 months, you can qualify for our Classic or Benefits Checking Accounts.

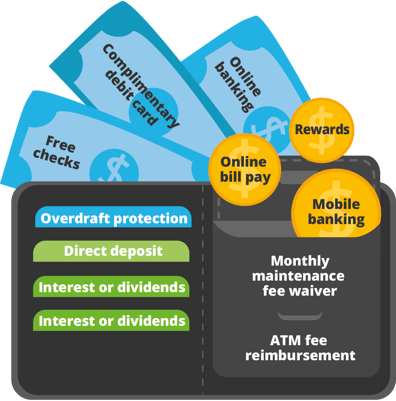

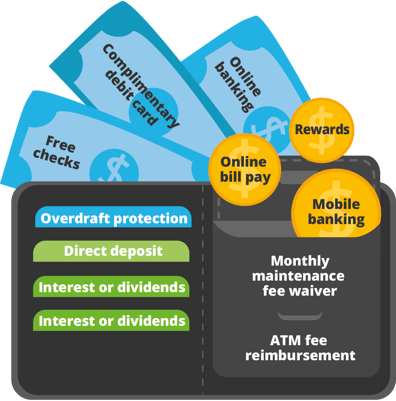

What Type of Features Should I Look for When Choosing a Checking Account?

Let’s review some of the checking account features you should look for when choosing a personal checking account:

- Complimentary debit card

- Free checks

- Online banking

- Online bill pay

- Mobile banking

- Overdraft protection

- Direct deposit

- Interest or dividends

- Rewards

- Monthly maintenance fee waiver

- ATM fee reimbursement

You should always review monthly checking account fees and read the fine print to identify hidden fees.

What Are the Pros and Cons Between Different Types of Checking Accounts?

Each type of checking account has its pros and cons. Here are some of the most important pros and cons that you should consider. (Note that we have not repeated pros and cons that apply to most checking accounts, such as federal insurance from the NCUA or FDIC)

Traditional Checking

| PROS |

CONS |

| Easy access to your money with a free debit card |

You won’t earn interest on your balance |

| Many accounts come with free checks |

You may pay a monthly service charge and other fees |

| Checking accounts are insured by the NCUA or FDIC |

|

Free Checking

| PROS |

CONS |

| Free debit card |

Limited features |

| No fees |

|

Interest-Bearing Checking

| PROS |

CONS |

| Comes with the same features as a traditional checking account |

There will likely be a minimum balance requirement to earn dividends or interest |

| You can earn dividends or interest on your balance |

|

Rewards Checking

| PROS |

CONS |

| Comes with all standard checking features |

There may be limits on how many points you can earn |

| You’ll earn rewards when you make purchases with your debit card |

Points may expire |

Student Checking

| PROS |

CONS |

| Designed especially for college students |

May not reimburse for foreign ATM fees |

| Comes with features to help students budget and learn how to manage their money |

|

Second-Chance Checking

| PROS |

CONS |

| Available to people who have had difficulty with overdrafts in the past |

Very limited features are available |

| Designed to help people get a fresh start |

There may be a direct deposit requirement |

| Can usually switch to a traditional checking account after a year |

|

How Do I Choose the Best Checking Account for My Needs?

You may be wondering how to choose a checking account that meets your specific needs. Here are some pointers to help you do that.

Confirm NCUA or FDIC Insurance

When you search for credit unions or banks, your first step should be to confirm that the financial institutions you’re considering are covered by NCUA or FDIC insurance. Either option will protect your deposits up to $250,000. Be cautious with online banks, which may not be insured.

Choose the Right Type of Checking Account for Your Needs

Depending on your needs and preferences, you may want a traditional checking account, an interest-bearing account or a student account. Reviewing the information and pros and cons we’ve listed here can help you to narrow your choices and choose the type of checking account that’s best suited to your needs.

Compare Account Features

Once you’ve narrowed your choice of financial institutions and know which type of checking account you want, it’s time to compare account features. At minimum, you should expect to get a supply of checks, a complimentary ATM card and access to secure online and mobile banking. You may want to factor in some additional features, such as overdraft protection, online bill pay and access to financial management tools and education.

Compare Account Fees

Account fees may vary greatly among financial institutions, so make sure that you understand which fees will apply to you and whether there are waivers available to you. As we have noted, many financial institutions will waive their monthly service charge if you maintain a minimum balance and some may reimburse account holders for a specified number of foreign ATM fees.

Compare Interest and Dividends

If you’re opting for an interest-bearing account, you should compare dividend and interest rates to choose the account that offers the biggest return on your deposit. As a rule, credit unions offer higher returns (and lower fees) than banks. As you review interest rates, make sure you understand any minimum balance requirements and other limitations.

Compare Support Options

Getting the support you need is a must when you’re entrusting someone with your money. We suggest reviewing the available support options, which may include phone support, live chat, in-app mobile support and access to an online library of educational materials such as blog posts, guides, podcasts and more.

Review Other Financial Products

Before you open a checking account, we suggest reviewing the other financial products available at your credit union or bank. Many credit unions, including Addition Financial, offer discounts on safe deposit boxes and reduced interest rates on mortgages and other consumer loans to their checking account holders.

Read Online Reviews

We strongly recommend reading online reviews before you choose a checking account. Online reviews can tell you a lot about what it’s like to have an account at a financial institution, with useful information about customer service, features and more.

Find Your Perfect Checking Account at Addition Financial

Choosing the right checking account requires research and an understanding of the various types of accounts–and account features–that are available. The information and pros and cons we’ve listed here can help you narrow your choices and select the right account for your needs.

Are you looking for a personal checking account with affordable fees and features that will allow you to take control of your finances? Addition Financial is here to help! Click here to learn about our checking account options and become a member today.