Table of Contents

Have you found yourself in a cycle of working hard, but your paycheck seems to disappear? Are you hustling from paycheck to paycheck and struggling to pay your bills? These scenarios can be all too common if you do not have a budget or foundation for your finances. Everyone needs assistance at some point in their financial journey, and budget counselors can be a great way to set up more structure and deep dive into how you could better spread out your funds. Budget counseling is a service that helps individuals and families manage their finances by creating and maintaining a budget, developing debt management skills, and achieving financial goals. It involves working with a counselor to assess current financial situations, create spending plans, and establish achievable financial goals. Financial stress shouldn’t be part of your daily life, so if you are experiencing this, a budget counselor might be helpful to you.

Have you found yourself in a cycle of working hard, but your paycheck seems to disappear? Are you hustling from paycheck to paycheck and struggling to pay your bills? These scenarios can be all too common if you do not have a budget or foundation for your finances. Everyone needs assistance at some point in their financial journey, and budget counselors can be a great way to set up more structure and deep dive into how you could better spread out your funds. Budget counseling is a service that helps individuals and families manage their finances by creating and maintaining a budget, developing debt management skills, and achieving financial goals. It involves working with a counselor to assess current financial situations, create spending plans, and establish achievable financial goals. Financial stress shouldn’t be part of your daily life, so if you are experiencing this, a budget counselor might be helpful to you.

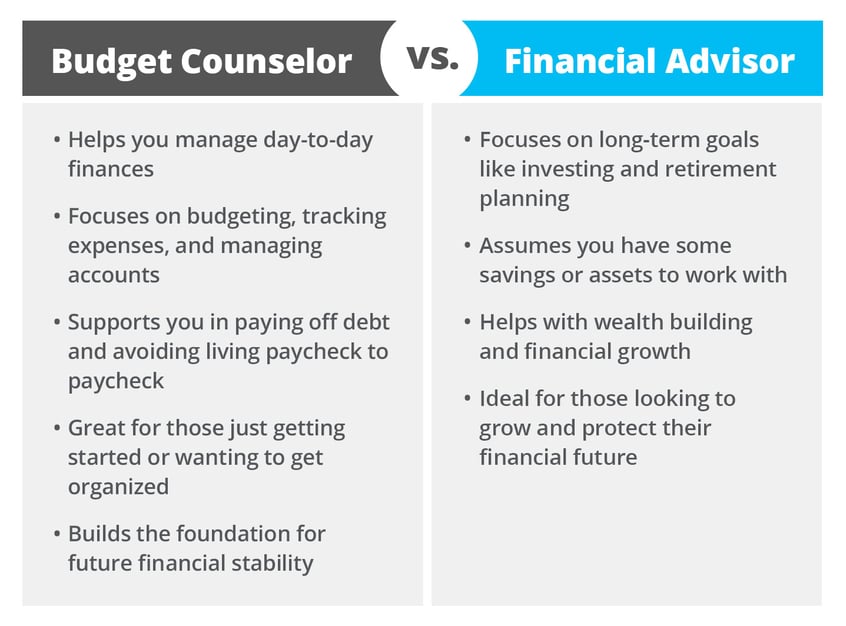

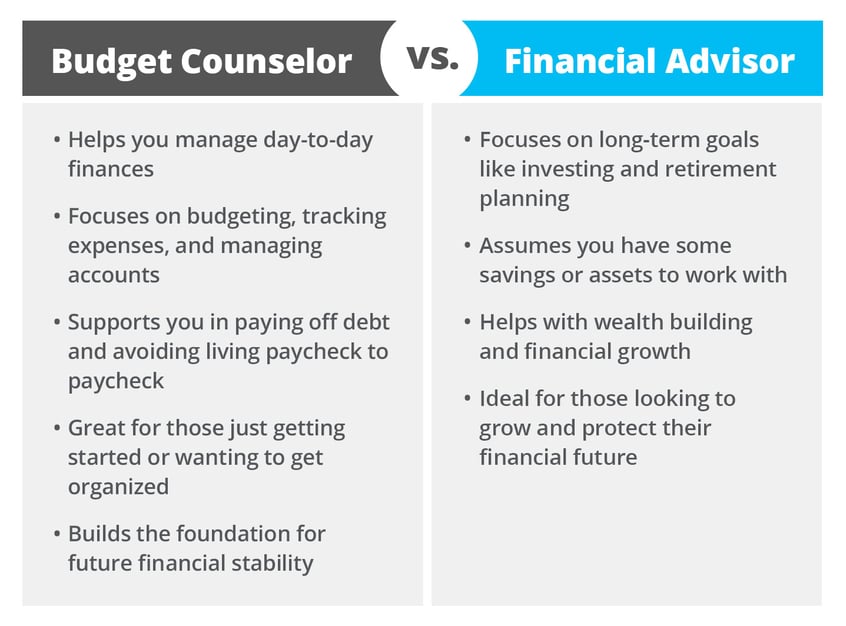

Budget Counselor vs. Financial Advisor?

If managing your finances feels overwhelming, you're not alone, and you don’t have to figure it all out by yourself. Whether it's juggling regular expenses, keeping up with bills, or trying to reach long-term goals like saving for a home or paying off debt, having support can make all the difference.

That’s where a budget counselor comes in. They focus on helping you take control of your day-to-day money management, things like building a realistic budget, tracking expenses, managing your accounts, and making sure you're not just getting by, but making progress.

It’s important to understand how this differs from a financial advisor. While both roles support your financial well-being, they serve different purposes. A budget counselor helps you manage your current income, spending, and debt, essentially, the financial foundation of your life. A financial advisor typically focuses on long-term investing, wealth building, and retirement planning, often assuming you already have savings to work with. If you’re not quite ready to invest but want to stop living paycheck to paycheck or finally get your finances organized, a budget counselor might be the right place to start.

At Addition Financial Credit Union, we believe that financial freedom begins with strong money habits and practical support. Budget counseling is designed to give you the tools, structure, and confidence to make smarter financial decisions now, so you can plan for a more secure future later. Our helpful team members can provide resources and expert advice in following through with your new budget.

Signs You Might Need a Budget Counselor

You’ll find benefit in using budget counseling services if you find yourself in these situations:

1. You're Living Paycheck to Paycheck

If you are not seeing growth in your savings, you don’t have an emergency fund set up for those “just in case” situations, or you feel the strain of financial stress, no matter where you are in a pay cycle, this is a big reason to seek help. When asked the question, “Do you often find yourself with no money left by the end of the month?”and you easily reply yes, you might need assistance sorting through your bills and accounts.

2. You Don’t Know Where Your Money Goes

If you’re not tracking your expenses or checking your transaction history regularly, it’s easy to lose sight of where your money is going. Whether it’s small purchases adding up or multiple accounts making things hard to follow, the lack of a clear budget can leave you feeling out of control. If you answered yes to the question, “Are you unsure where your money is going each month?” it might be time to consider working with someone who can help you organize your finances and build a clearer picture of your spending habits.

3. You Rely on Credit Cards or Loans to Cover Regular Expenses

If credit cards or personal loans have become your safety net for everyday necessities like groceries, gas, or utilities, that’s a sign that something in your budget isn’t working. Carrying balances and making only minimum payments each month can quickly lead to mounting debt. When asked, “Do you use credit cards to get through the month?” and your honest answer is yes, budget counseling can help you uncover the root of the issue and create a plan to rely more on income than credit.

4. You Struggle to Make Payments or Are Falling Behind on Bills

Missing due dates, paying bills late, or having to decide which bill gets paid first each month creates a constant cycle of stress. If you’re juggling payments just to stay afloat, you may need outside help to prioritize expenses and rebalance your finances. If the question “Have you had to choose between which bills to pay?” hits close to home, a budget counselor can guide you in creating a plan that works with your income and obligations.

5. You Have Financial Goals but No Plan to Reach Them

Whether your goal is buying a home, becoming debt-free, or saving for retirement, achieving it without a plan can feel overwhelming. If your income seems to disappear before you can allocate anything toward your goals, it’s a sign you could benefit from guidance. When asked, “Are you unsure how to reach your financial goals?” and you answer yes, working with a budget counselor can help you create a step-by-step approach to move from intention to action.

How a Budget Counselor Can Help

If any of these signs sound familiar, the good news is that you don’t have to tackle them alone. A budget counselor offers guidance and support to help you get a clearer view of your financial picture—and take control of it. They work with you to build a realistic budget based on your income and expenses, prioritize your payments, and set achievable financial goals.

One of the biggest benefits of working with a counselor is having someone who can help you track your expenses and identify spending patterns that may be holding you back. They can also guide you in creating a savings plan, managing multiple accounts, and reducing or eliminating reliance on credit cards or loans for basic needs.

At Addition Financial Credit Union, we understand that everyone’s financial journey is different. Whether you’re just starting out or trying to recover from financial setbacks, our budget counseling services are designed to give you the educational content, confidence, and personalized support you need to move forward. With the right plan in place, financial peace of mind is within reach.

Addition Financial Always Has Your Back

Needing help doesn’t mean you have done anything wrong. You are doing everything right by trying to take smart steps to help your financial situation. No one is required to figure out everything money-related on their own. At Addition Financial, we want to cheer you on as you meet your financial goals, stay on budget, and remove financial stress from your life.

Needing help doesn’t mean you have done anything wrong. You are doing everything right by trying to take smart steps to help your financial situation. No one is required to figure out everything money-related on their own. At Addition Financial, we want to cheer you on as you meet your financial goals, stay on budget, and remove financial stress from your life.

If you have a plan in mind after visiting a counselor or want us to help you get started, give us a call or drop by a branch at your convenience so we can answer your questions and address the challenges you may be facing. Also, you’ll be a pro after downloading our resource: Unlock the Vault: A Guide to Utilizing Financial Resources. Consider it our gift to you for wanting to make the most of your money.

Have you found yourself in a cycle of working hard, but your paycheck seems to disappear? Are you hustling from paycheck to paycheck and struggling to pay your bills? These scenarios can be all too common if you do not have a budget or foundation for your finances. Everyone needs assistance at some point in their financial journey, and budget counselors can be a great way to set up more structure and deep dive into how you could better spread out your funds. Budget counseling is a service that helps individuals and families manage their finances by creating and maintaining a budget, developing debt management skills, and achieving financial goals. It involves working with a counselor to assess current financial situations, create spending plans, and establish achievable financial goals.

Have you found yourself in a cycle of working hard, but your paycheck seems to disappear? Are you hustling from paycheck to paycheck and struggling to pay your bills? These scenarios can be all too common if you do not have a budget or foundation for your finances. Everyone needs assistance at some point in their financial journey, and budget counselors can be a great way to set up more structure and deep dive into how you could better spread out your funds. Budget counseling is a service that helps individuals and families manage their finances by creating and maintaining a budget, developing debt management skills, and achieving financial goals. It involves working with a counselor to assess current financial situations, create spending plans, and establish achievable financial goals.

Needing help doesn’t mean you have done anything wrong. You are doing everything right by trying to take smart steps to help your financial situation. No one is required to figure out everything money-related on their own. At

Needing help doesn’t mean you have done anything wrong. You are doing everything right by trying to take smart steps to help your financial situation. No one is required to figure out everything money-related on their own. At